Continuing our playlist of commodities, today we’ll talk about wheat, a market worth almost 200 billion dollars, the second most cultivated plant in the world, after corn.

Corn, wheat, and rice account for 2/3 of the calories we consume. Each person in the world ingests more than 65 kg of wheat per year. So if you like bread, pizza, or making money, stay until the end to learn everything about this market.

The Cultivation of Civilization

Wheat was one of the first plants to be cultivated by humanity, enabling the first human settlements 10,000 years ago in the Fertile Crescent. To this day, 2.5 billion people consume it daily.

There are 800 million tons of wheat produced per year. Two-thirds are for human consumption, 20% for animal feed, and another 14% for industrial use, such as paper production and biofuels, medicine capsules made from starch, and skin creams from wheat germ. So nearly 70% of wheat is used for our consumption, unlike corn, where only 10% serves this purpose. Wheat-derived foods are even more crucial in developing countries.

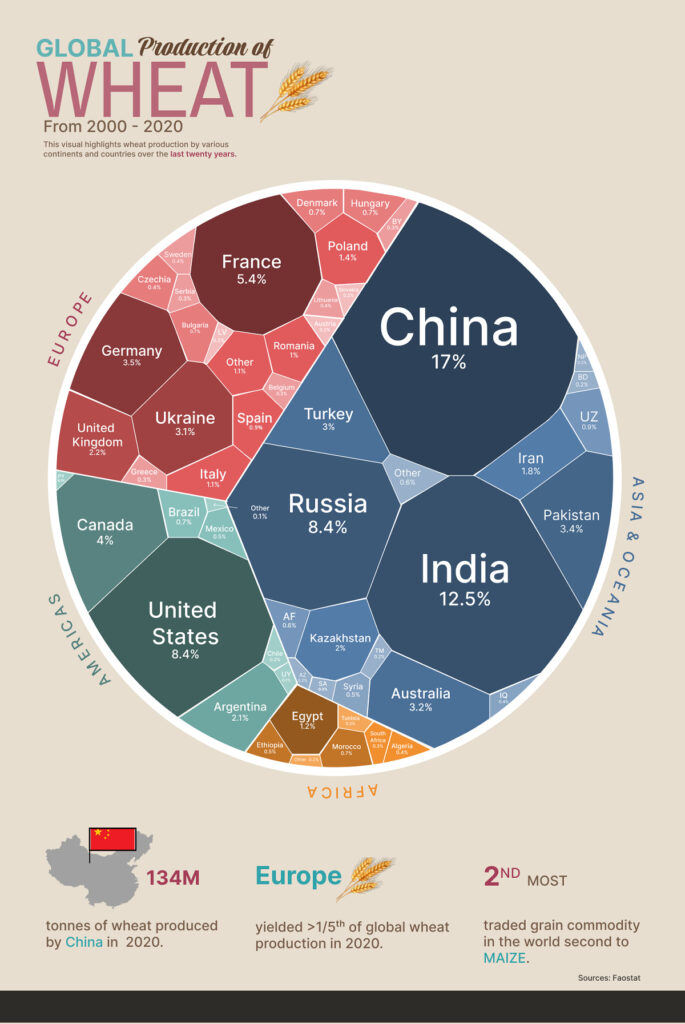

The Largest Wheat Producers

The success of wheat stems from its versatile use and ease of cultivation, occupying an area of 500 million acres, or 2 million square kilometers dedicated to wheat cultivation. The world’s largest producers are the European Union, China, and India, followed by Russia and the United States, with Asians being so populous that they also need to import wheat.

China is the 3rd largest importer, after Egypt and Turkey, and before Indonesia and Italy, all with a culinary culture of bread and pasta.

Wheat is one of the few agricultural products in which Brazil is not among the major exporters. In fact, it is the ninth largest wheat importer in the world, importing 5 million tons from Argentina every year. This is because wheat prefers to grow between 15 and 20°C.

The Greatest Risks in the Wheat Market

As wheat is an agricultural commodity, significant risk factors include weather conditions such as droughts, floods, and frosts, which affect crop productivity. Government policies, such as subsidies and tariffs, and the exchange rate, where a higher dollar price increases input costs and the price of wheat, also pose risks. Additionally, the dynamics of supply and demand play a crucial role. For example, there has been an increase in demand for weissbier, wheat beer.

Investing in Wheat: Stocks

Wheat as an agricultural commodity can serve as a refuge in times of economic uncertainty, a way to diversify your portfolio, and speculate on the price of an essential grain. This is not an investment recommendation. The largest processing and trading companies in wheat include the Chinese COFCO, operating in over 160 countries, and the American companies Archer-Daniels-Midland (ADM), Bunge (BG), and Cargill. However, the latter is privately held and not traded on the financial market.

Investing in Wheat: ETFs

In addition to stocks, you can invest in ETFs, such as WEAT, an ETF that tracks the price of wheat futures contracts, or WEET, from iPath, which follows the price of wheat on Bloomberg, or DBA, from Invesco, which replicates the performance of a basket of commodities including wheat.

It’s also possible to trade directly the price of wheat through derivatives, which I’ll show you now, but it’s important to check the regulations in your country. We have people from all over the world reading this article, so what applies to one may not apply to another.

Check out the video where I analyze the wheat price chart: