In this article, we’ll explore how some wars have impacted the financial market, specifically the stock market, and you’ll be surprised by what I’ll show you here. Analyzing charts of important stock indices from World War I to the recent invasion of Ukraine, I can guarantee that there is no other article like this one, so stick around until the end.

How do wars affect the economy and the financial market? Do stocks depreciate or appreciate with the escalation of a military conflict? Does the war effort sacrifice economic growth and crash the capital market? Well, the interesting thing is that it’s not a subjective matter; we can see in the charts how much markets have fallen or risen during significant wars.

World War I

Without further ado, let’s start with the war that was supposed to end all other wars, World War I, when stock exchanges closed for almost 5 months. Never before in history had the stock market been closed for trading for such an extended period. World War I began on July 28, 1914, following the assassination of Archduke Franz Ferdinand, the heir to the Austro-Hungarian throne, and lasted until November 11, 1918.

This war involved the major powers of the world, which organized into two opposing alliances: on one side, we had the United Kingdom, France, and Russia, and on the other side, the Austro-Hungarian and German empires. As the conflict escalated, more nations joined and allied themselves with one of the sides.

Approximately 70 million soldiers from 30 countries across five continents were involved in this war, resulting in the deaths of approximately 10 million men in combat—excluding millions of other lives lost indirectly due to the war. About 6,000 men died every day during the war.

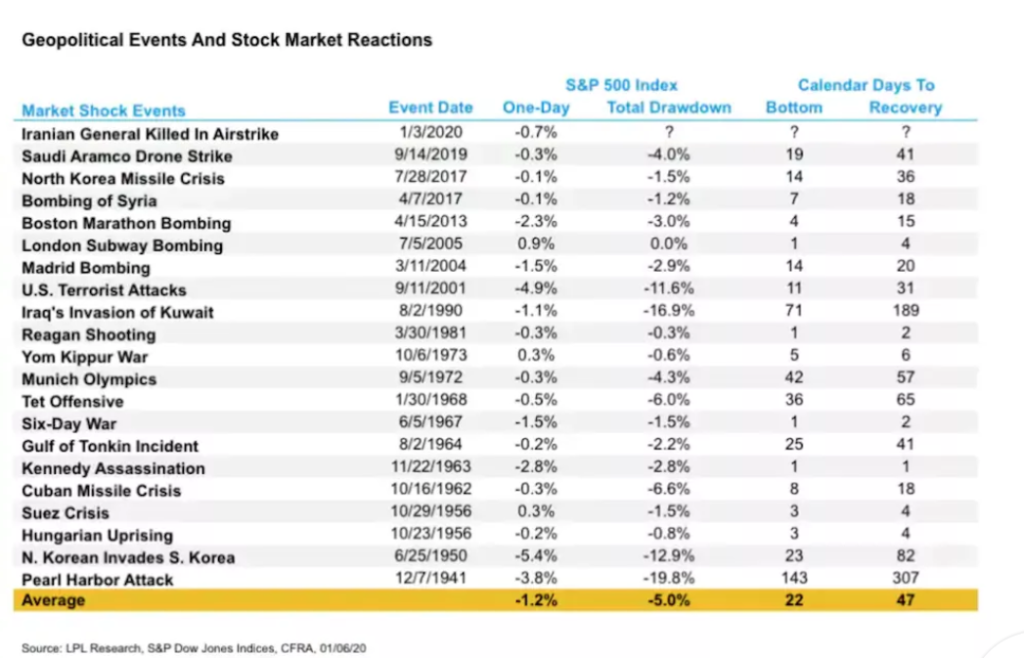

In just one battle (the Battle of the Somme), 1 million men died. Did the stock market rise or fall during World War I? I found a study by LPL Research that compares the stock market’s reaction to major geopolitical events.

World War II

In this column, we can see how much the S&P 500 plummeted in a single day after the geopolitical event. The invasion of South Korea by North Korea caused stocks to drop in one day more than the attack on Pearl Harbor, which resulted in the United States’ entry into World War II. However, in the aggregate, the attack on Pearl Harbor caused the stock market to plummet by nearly 20%, taking 143 days to reach the bottom and 307 days to recover.

An important detail is that the modern S&P 500 was only launched in 1957, and here we are looking at an event from the 1940s. So, I will now open the Dow Jones index, and we know that the attack occurred on December 7, 1941, when a fleet of 353 Japanese aircraft attacked the American military base located in Hawaii.

In addition to this fleet of aircraft, there were five Japanese submarines, and the attack resulted in the deaths of 2,403 military personnel and 68 civilians. It also destroyed 19 ships, including the USS West Virginia, and 188 American aircraft were destroyed, most of them on the ground, as it was a surprise attack and they did not have time to take off.

From the attack on Pearl Harbor on December 7, 1941, until the bottom in April 1942, we see nearly a 20% devaluation. But before this attack, there is a very important event to analyze, which is the beginning of World War II when Hitler invaded Poland in the fall of 1939, breaking the non-aggression pact with the Soviet Union. Communists and Nazis were cut from the same cloth of authoritarianism.

Do you think the stock market went up or down when Hitler invaded Poland, starting World War II? On September 1, 1939, there was a violent gap up, with a 15% increase in stocks in just a few days. However, after September 15, 1939, two weeks after the start of World War II, the stock market melted down to the bottom in April 1942, with a depreciation of around 40%.

But the war started with a 15% gap up, indicating that things are not as simple as “does the stock market go up or down with war?” It’s more complex than that. Initially, it can go up, then it melts down, or it can start falling and then rise. The only certain thing is the increase in volatility due to the uncertainty factor.

If we want to conduct a more in-depth study, we could analyze how each sector of the economy reacted to see which sector tends to rise the most in a war situation. I could do that in the future in a part 2 of the war and market analysis.

Vietnam War

The Vietnam War is also an important conflict to be analyzed regarding the reaction of the S&P 500. More specifically, from the direct involvement of the United States after the incident in the Gulf of Tonkin, off the Vietnamese coast, on August 2, 1964, when an American ship on a spying mission was attacked by North Vietnamese military.

Let me provide some context for those who may have slept through history classes. North Vietnam was communist and had support from the Soviet Union and China, while the United States and its allies supported South Vietnam economically and militarily from the beginning of the war between the North and the South on November 1, 1955.

However, it was only in 1964 that the United States became directly involved, with soldiers setting foot on North Vietnamese soil after the Gulf of Tonkin incident. This incident prompted the US Congress to pass the Gulf of Tonkin Resolution, authorizing President Lyndon Johnson to enter the war.

A recommended documentary on the Vietnam War is by Ken Burns; I highly recommend it. But now, let’s focus on the financial market and see the reaction of the S&P on August 2, 1964, after the Gulf of Tonkin incident. The Vietnam War officially ended on April 30, 1975, so our graphical analysis will span from November 1, 1955, to April 30, 1975.

Invasion of Kuwait

Returning to the LPL Research spreadsheet, what catches my attention is the invasion of Kuwait by Iraq, which led to a depreciation of the S&P 500 by 16.9% and took 189 days to recover. I know I’m skipping important wars, like the Korean War or the Iran-Iraq War in 1979. The idea is to do a part 2 discussing other wars, but you have to let me know if you’re interested.

So, the Gulf War began on August 2, 1990. I always mark it with the vertical yellow line, but let me pull it back to the day before so we can visualize the candle of the event day well. You can see that the American stock market fell on the day Saddam Hussein invaded Kuwait.

However, the bearish pivot had already been confirmed before that, so those who use technical analysis would have been selling even before the invasion. People might even think you have insider information and knew about the invasion, but no, it’s because you use technical analysis and follow the O Cara do Mercado channel.

September 11

And how did the stock market respond to the invasion of Afghanistan after the September 11 attacks, when Al-Qaeda terrorists hijacked 4 commercial airplanes with passengers on a suicide mission, hitting the twin towers and the Pentagon, and the fourth plane was intended to hit either the White House or the Capitol, but crashed before reaching its targets as passengers attempted to regain control of the aircraft.

Remember that in this LPL study, it shows the metrics of the S&P 500 after the September 11 attacks? But I want to see it on the graph. The yellow line marks the day before the attacks, September 10, 2001, and then the stock market only opened on September 17 with a downward gap.

Remembering that the U.S. Congress approved legislation entitled Authorization for Use of Military Force Against Terrorists, which was signed on September 18, 2001, by President George W. Bush. This authorized the use of the United States Armed Forces against those responsible for the September 11 attacks.

On October 7, 2001, the armed forces of the United States and the United Kingdom began bombing Afghanistan, with the aim of attacking the Taliban and Al-Qaeda, and look what happened to the S&P 500, it went up.

Notice that if you make investment decisions based on news, because you turned on the TV and saw that Bush invaded Afghanistan, you will almost certainly lose money. There is a maxim in the market that says the following: a market that reacts well to bad news is a strong market. A market that reacts poorly to good news is a weak market.

With war or without war, the economy will not completely stop. We saw that even in the first war when the stock markets closed for almost 5 months, then the stock market broke top after top and ended the war above the levels it started. For these and other reasons, the best way to make the decision to buy or sell stocks is through technical analysis.

So here the price was leaving higher highs and higher lows, that is, an uptrend, I have to be long. “Oh, but a war is starting, but the zombie apocalypse is starting,” I don’t care, if the trend is up, I’m long, if the trend is down, I’m short.

Invasion of Ukraine

Finally, let’s talk about the invasion of Ukraine. On February 24, 2022, Russia invaded Ukraine. It was the largest attack on a European country since World War II, resulting in the biggest refugee crisis since then. I can’t go into too much detail about this specific conflict because of YouTube’s algorithm, it could harm the channel.

But I can show you this graph, emphasizing that nothing here is investment advice. In this war, I have to say this because it’s still ongoing. We’re looking at the daily chart of the S&P 500, and I marked February 24, 2022, with this yellow line.

For those who don’t remember, there was already significant military movement on the borders of Ukraine many weeks before the invasion, so our analysis could start even before this yellow line. You can see that the market had already been pricing in this instability and potential conflict in Europe.

And then you see that the day of the invasion was the day of the biggest rally in the S&P 500 in a long time. There’s a saying in the financial market, “buy the rumor, sell the news.” It’s evident that if the news has a negative bias, such as in the case of a war, which has economic and humanitarian costs, the same logic applies, but in the opposite direction. In this case, people sold the rumors of a possible war, and when the conflict actually erupted, the market corrected itself.

Should I Trade Wars?

The key here is to understand that the market had already been pricing in the conflict, as the charts reveal. For those who use technical analysis, they didn’t even need to know what was happening in Europe; it would suffice to sell the loss of the low pivot and project 100%.

Even understanding this market logic of gradually pricing in events, it’s strange to see the stock market rising on the day a significant geopolitical conflict erupts. After all, during a war, economic resources are diverted to this purpose. It’s a classic economic trade-off: guns versus butter. In brief, for those who are puzzled: the more spent on national defense to protect the country from external aggressors (guns), the less spent on personal goods to increase the standard of living (butter).

If I allocate $100 billion to purchase tanks, rifles, etc., these same $100 billion won’t be going to areas that would actually improve the population’s standard of living. In other words, naturally, we have the instinct to think that when a war breaks out, the stock market will plummet, but as I demonstrated throughout the video, this isn’t true.

The Ukraine war affected the entire production chain, and we saw a sharp rise in commodity prices, with the most important one, oil, soaring by about 40% from the closing of February 23, 2022, one day before the invasion of Ukraine, until the peak on March 7.

As of the recording of this video, the conflict is ongoing, but I think we can already draw some conclusions about the impact of wars on the stock market. Notice that despite the sanctions, Russia still manages to profit since the commodities they sell, such as oil and natural gas, appreciated significantly during the war.

War Lessons for Traders

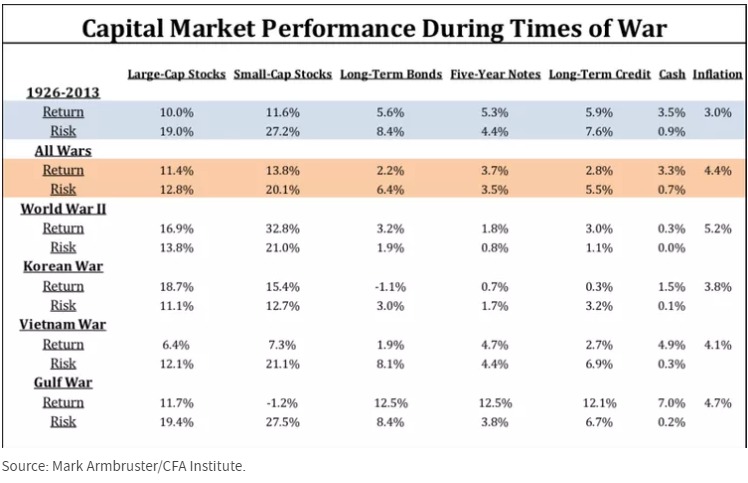

We’ve seen that even with a war raging, the stock market can end up at higher levels than when the war broke out. And wars have less of an impact on the financial market than major financial crises. The biggest drops in the stock markets didn’t occur during wars; they occurred during financial crises such as the 1929 crash, the 1987 crash, the 1999 bubble, and the 2008 subprime crisis.

Even the 2020 pandemic caused the stock market to plummet at a much faster rate than the most geopolitically significant wars. And as we’ve seen, even if the stock market depreciates initially, it eventually recovers and ends up appreciating between the start and end of a major war. In other words, the risk of being out of the stock market is always the greatest risk. And I take this opportunity to invite you to invest and trade in the Brazilian stock market through BTG Pactual.

Watch my video on Wars and the Market:

>> See also:

2 Responses