Soybeans: From Food to Trading

Soybeans are one of the four essential agricultural crops for human consumption, along with wheat, corn, and rice. In this article, I’ll explain everything about soybeans and investments in soybeans, and at the end, I’ll share a video where I demonstrate the practical aspects of trading soybeans.

In addition to serving as food, soybeans are also part of the feed for most animal species, from fish and shrimp to birds and cattle. Another area where soybeans stand out is in biofuel production, with its biodiesel serving everything from passenger vehicles to heavy machinery.

Let’s explore how soybean cultivation has gained such importance in the modern economy and what you need to know to trade commodities like soybeans and profit from price volatility.

From China to the World: The Story of Soybeans

Soybeans have a fascinating history dating back thousands of years. Originating in China, the earliest records of soybean cultivation date back to 13,000 years ago, making it one of the oldest crops domesticated by humans.

Throughout the centuries, soybeans played a significant role in Asian agriculture and cuisine. They were valued for their high protein content and versatility. The Chinese developed fermentation techniques to create soy-derived products such as soy sauce, miso, and tofu, which became essential elements of Asian cuisine.

The spread of soybeans to the rest of the world began in the 18th century when missionaries and travelers brought soybean seeds to Europe and the Americas. But it was in the 20th century that soybeans became a central product in the modern economy.

This was because during the 20th century, there was a significant increase in global demand for plant-based protein. Soybeans stood out as a crop with high protein content and the ability to be cultivated on a large scale. Additionally, the discovery of methods to extract soybean oil and produce animal feed further boosted its cultivation.

The New World and Soybeans: The Largest Producers

The expansion of soybean cultivation gained momentum in North and South America. In the United States, soybeans became a significant crop in the Midwest, where the climate and soil are conducive to cultivation.

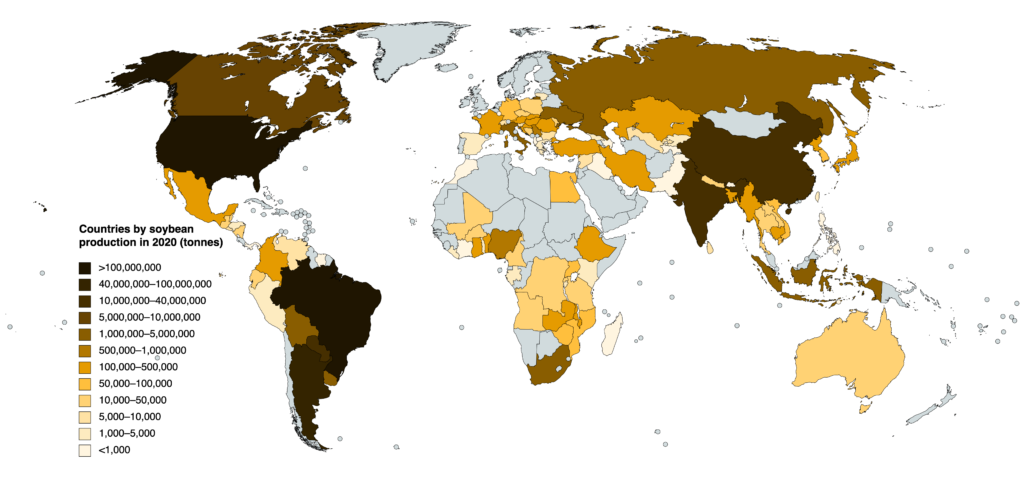

The development of advanced agricultural techniques, such as the use of herbicide-resistant seeds, also contributed to increased productivity. In Brazil, the expansion of soybeans in recent decades has been such that the country has become the world’s largest producer, with over 120 million tons per year, primarily due to Chinese demand for pork feed.

The second-largest producer in the world is the United States, followed by Argentina in third place, and only then comes China, where soybeans originated. This is because Brazil has much more water and arable land than China, especially in the Cerrado region, with the largest producers being the three states of the Midwest and the two southernmost states of the country.

From Plant to Commodity: Soybeans on the Exchange

As demand for soybeans and its byproducts grew throughout the 20th century, it became necessary to establish standardized prices and contracts for this market, effectively making soybeans a commodity. Commodity trading can take the form of futures contracts, where buyers and sellers agree to deliver a certain quantity of the commodity on a specified future date.

Futures contracts allow market participants such as producers, processors, and traders to hedge against price fluctuations and ensure they will have the product in stock.

In the case of soybeans, the first futures contract was launched on the Chicago Board of Trade in 1946, and for soybean oil in 1950.

Over time, the trading of soybean futures contracts expanded to other markets, reaching Brazil in 1997 when the Brazilian Mercantile and Futures Exchange (BM&F) launched the Soybean Futures Contract, and in 2006, the Soybean Oil Futures Contract.

From Seed to Oil: A Dual Commodity

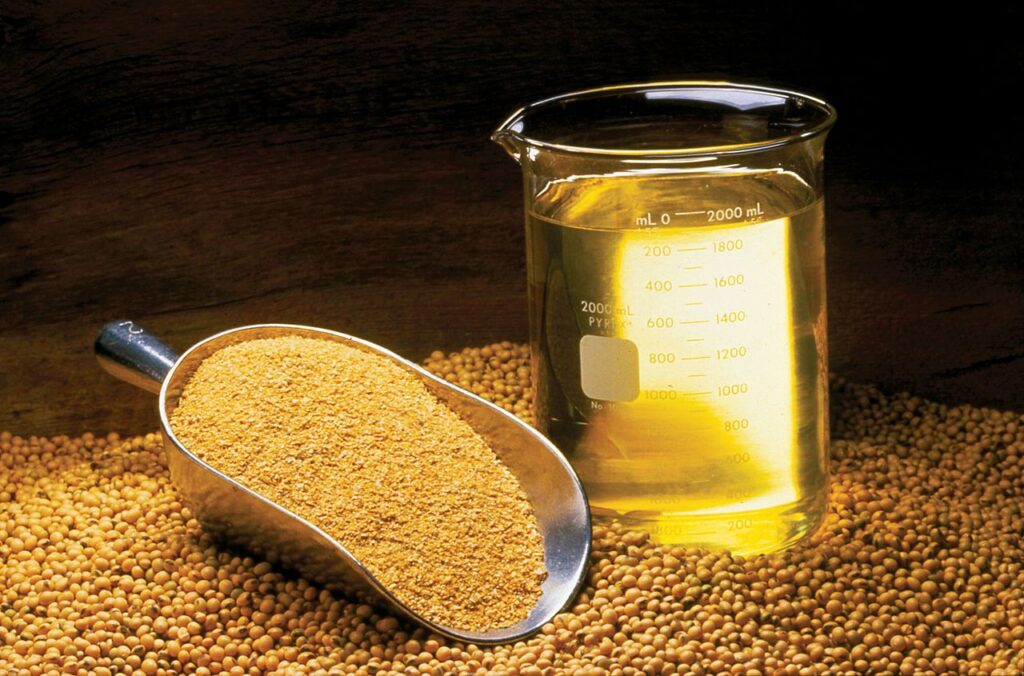

Soybean oil is a byproduct extracted from soybean seeds and has various applications in the food industry, such as in bread, frying, processed foods, and it is also used in biodiesel production. Soybeans and soybean oil are traded as separate commodities due to their specific characteristics.

The separate trading of soybeans and soybean oil arose to meet the needs of producers, processors, and traders who sought specialized trading for these two products. The distinction between them allowed for more precise risk management, greater price transparency, and standardization of these products in their respective futures markets.

Analysis Technical: Trends and Opportunities

Now let’s see what we should observe to profit from the soybean market using technical analysis, where the price already reflects other factors such as economic fundamentals, weather conditions, and news.

Technical analysis is widely used for shorter timeframes, allowing you to buy and sell soybeans on the same day or within a few weeks, but it can also be used for long-term investments. You define your time horizon and investment profile.

In fact, this article does not recommend buying or selling soybeans, and the platform I use to trade commodities like soybeans may not be suitable for your profile.

From Asia to the World: The Thriving Commodity

It’s fascinating to think that soybeans originated in East Asia and spread throughout the world, becoming one of the most important agricultural commodities in Brazil, sustaining a significant part of civilization. Both directly, as a source of vegetable protein, and indirectly, by serving as feed for the animals that provide us with animal protein.

What’s even more incredible is that soybean biodiesel also ‘fuels’ the very agricultural machinery that made soybean cultivation so successful worldwide, powering tractors and harvesters, as well as cars, trucks, and electric generators.

Check out my video below on how to trade soybeans: