In this article, we’re going to cover everything about the silver market, and when I say everything, I mean everything—there will be charts, comparisons with gold, the history of silver, and metrics of this market. You’ll even understand why silver is the enemy of interest rates.

The purpose here is to provide you with the maximum amount of information about silver if you’re considering investing or day trading in silver. But don’t confuse this with investment advice; whether you invest in silver or not will depend on your risk profile and strategy.

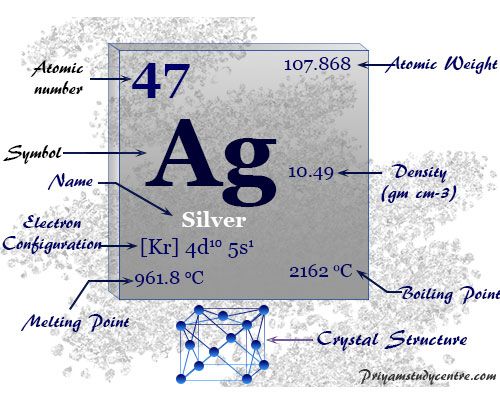

Let’s start from scratch: Silver is a precious metal, that’s common knowledge, but perhaps you didn’t know that this element is known to be the most reflective, conductive, and malleable element in nature, and as such, it has been valued by humanity for over 5,000 years.

In addition to its traditional use as currency and in jewelry, it currently has various practical applications in the electronic, medical, and energy industries. That’s why around 25,000 tons of silver are mined every year, creating a $20 billion market. But where did this relationship between humanity and silver all begin?

The Millennia-old History of Silver

The earliest recorded silver objects date back 5,000 years ago in Anatolia, modern-day Turkey. These objects include intricate jewelry, coins, and domestic silverware, indicating that silver was already being crafted long before that time, serving the same purposes it would throughout its history: as jewelry (a symbol of wealth) and as currency (a store of value).

Following this, new mines began to emerge, such as in Athens, which flourished in antiquity after discovering the Laurion silver deposit. With this silver, they financed their naval empire and minted the drachma, the currency of Ancient Greece, which philosophers like Socrates and Plato used in their daily lives.

By around 100 AD, the mining center of the Roman Empire was Spain, where silver created the denarius, the Roman silver coin that originated the term ‘money’. It was used to trade for spices in the Far East along the Silk Road. In the 8th century, the Anglo-Saxons minted silver coins called ‘sterlings’, which gave rise to the modern British pound sterling.

The Cerro Rico de Potosí

But no event in the history of silver compares to what happened when the Spanish discovered Potosí, in present-day Bolivia. When they arrived in the Americas at the end of the 15th century, there was a legend among Europeans of a hidden city of gold in the forest, El Dorado. The Spanish didn’t find a city of gold, but instead, they found a mountain of silver: the Cerro Rico.

The year was 1545, and the llama shepherd Diego Huallpa got lost at 4,000 meters above sea level, where not even trees grow, and decided to make a fire to spend the night. Legend has it that when he woke up, he thought the stars had fallen upon him when he found himself surrounded by silver, which the Spanish had already discovered in Mexico.

The news spread to the surrounding villages, and overnight, thousands of people began arriving from all corners. In a few years, the city grew to 150,000 inhabitants, many of whom went mad due to mercury poisoning, which began to be used to separate the silver from the rock by amalgamating it with mercury.

The Cerro Rico became the source of a staggering 70% of the world’s silver. All the power that the Spanish crown had in the following centuries, with wars across Europe and expansion around the world, was financed by the ‘Real de Ocho’, the silver coin that the Spanish crown minted right there, around the mines of Potosí, from which the symbol of the dollar originated.

From Inflation in Spain to the Decline of Mercantilism

The flow of silver to Spain was so significant that after a few years, the price of everything rose in the economy: widespread inflation due to the large amount of silver in circulation, which was the ‘silver bullet’ for the downfall of mercantilism, the economic system that prevailed among European powers before capitalism.

The idea of mercantilism was that a nation’s wealth came from the accumulation of precious metals, such as gold and silver. After this ‘price revolution’ in Spain, we began to enter the capitalist paradigm, where a nation’s wealth comes not from the accumulation of metals, but from productivity and innovation.

The Geopolitics of Silver and the Opium Wars

The silver coin made Spain a power and was the international currency for almost three centuries, accepted from America to China. 200 years later, all the silver had been mined, and Potosí returned to 8 thousand inhabitants. Spain, which had its silver exhausted by the Romans, now depleted the silver of the Americas, for the same reason: to buy silk, tea, and porcelain.

Argentina itself is named after the Latin term for silver, which is ‘argento’, which also gives its name to silver in the periodic table: Ag. Even a guy I admire, Adam Smith, in his work ‘The Wealth of Nations’, mentions the large amount of silver that Europe sent to China every year for imports.

To reduce this amount of silver sent to China, England began paying for Chinese products in opium, which they produced in India, which addicted millions of Chinese, and generated the two Opium Wars in which China was occupied by several European powers in the 1860s, and which has ramifications in the Chinese psyche to this day.

Silver as Currency

All the power of silver in moving humans derives from the fact that it is universally accepted as valuable. Romans, Chinese, Spanish, peoples from everywhere and every era attribute value to this metal. There are four main factors that led silver to be adopted as currency by humanity:

Durability:

Silver is a durable metal that could be passed down through families for generations. Only after the industrial revolution did silver objects start to corrode due to sulfur in the air. So, nowadays, if you have family silverware, you may see it darken, but that wasn’t the case in ancient times, and simply using bicarbonate can solve this issue.

Malleability:

You can make silver leaves thinner than a hair without it breaking, which allowed us to work with silver and mint coins with the issuer’s shield or coat of arms.

Accessibility:

There is much more silver than gold on the planet, which favors silver for use in commercial transactions. Due to the rarity and value of gold, you are unlikely to buy bread with it, but with silver coins, you have this greater abundance of the material while still being a scarce commodity.

Acceptance:

Over time, the use of silver as currency spread across the planet and created a relationship of trust among peoples, who knew that anywhere that metal would be accepted to exchange for goods. Silver enabled global trade.

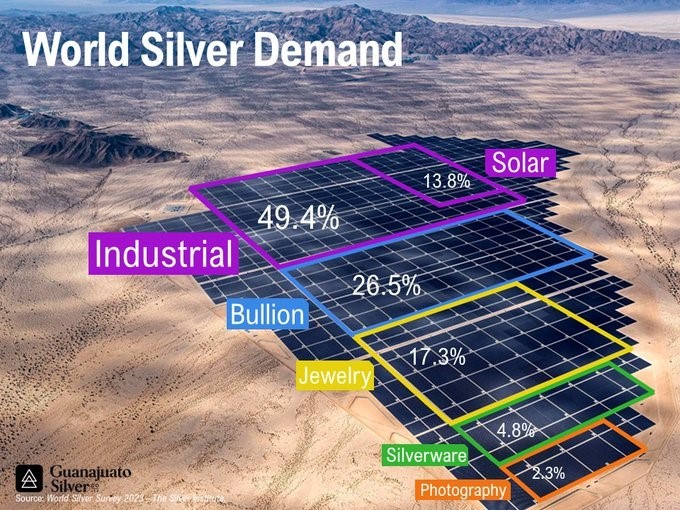

The Gold-Silver Relationship

Despite there being almost 20 times more silver than gold on Earth, only about 8 times more silver is mined than gold. Additionally, 70% of silver is used for productive purposes, such as in electronics and solar panels, while less than 30% of mined silver is for investment, leading to different dynamics compared to the gold market, where almost all gold mining is for investment purposes. Less than 10% of gold is used for purposes other than investment.

Although gold and silver mostly fluctuate in the same direction, the daily fluctuation of silver over the last five decades has been nearly 1%, double that of gold. This is because the silver market is much smaller than that of gold, approximately ten times smaller: the physical silver market is worth $20 billion annually, compared to the $200 billion gold market.

Therefore, a flow of money into or out of the silver market has a greater impact than the same inflow or outflow in the gold market, leading to increased volatility, which benefits traders. This market has good liquidity and volatility and is not limited to the $20 billion of mined silver; the derivatives market is leveraged hundreds of times, reaching trillions of dollars in value.

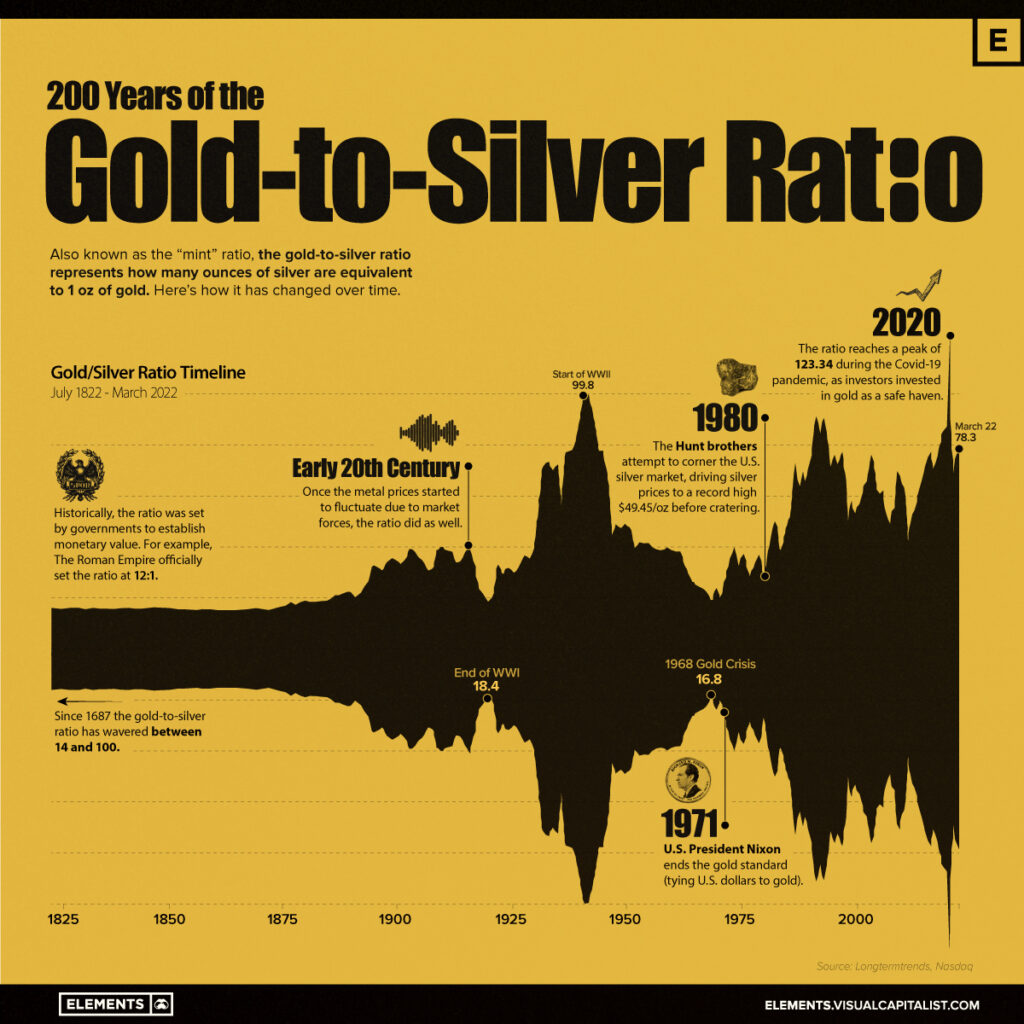

In places like ancient Egypt and medieval Japan, where there were fewer silver mines, the gold/silver ratio reached 3:1. However, the historical trend was for governments to establish a fixed ratio, which until the 1970s was around 15:1, reaching 100:1 at times like World War II and during the pandemic.

>> Also, check out: All about Platinum

Silver Mining

Seventy percent of silver is extracted as a byproduct of mining other metals such as gold, lead, zinc, and copper. It undergoes smelting and refining to obtain pure silver, ready for use by various industries.

Currently, 25,000 metric tons of silver are mined annually. Throughout human history, an estimated total of 1.5 million metric tons of silver have been mined. This amount could fit into a solid silver cube measuring 52 meters on each side, and it is estimated that there are still 500,000 metric tons of silver yet to be mined.

Since the late 19th century, advancements such as steam drilling and mine drainage have led to a massive increase in global silver production. It is estimated that between 1950 and 2020, 60% of the total mined silver in history was extracted. In the 50 years between 1900 and 1950 alone, more silver was mined than in all previous human history.

There is a real risk of depleting the planet’s silver reserves in a few decades, but by then, we will likely have new technologies to prevent this outcome.

Jewelry and Cinema: The Industrial Use of Silver

Scientific advancements in the 20th century also revealed that silver was one of the most versatile elements in the periodic table. In addition to traditional jewelry and coins, the reflective properties of silver salts were crucial for the emergence of mirrors, photography, and cinema. Twenty-five percent of industrial demand for silver still comes from photography, another 35% for jewelry and silverware, and the remaining 40% for other industries, with only 3% still used in coins.

Electronic components such as conductors and solar panels take advantage of silver being the best metal for conducting electricity. If you have a cell phone or computer, you carry around nanosilver, which are silver microparticles sprayed onto the plastic surfaces of the device to conduct electricity and protect against bacteria. That’s why the world’s largest buyers of silver are Samsung, Apple, General Electric, and Panasonic.

Silver in Medicine

One curiosity that surprised me when I discovered it is that silver has antimicrobial properties. So, in ancient times, pieces of silver were left in water and wine containers for preservation. Even during the westward expansion in the United States, Americans would cross the country with silver in their milk to prevent spoilage.

Since the 1960s, silver has become a part of surgical surfaces and hospital instruments because silver ions deactivate microorganism membranes. Silver is used in dressings, eye drops, creams, and for burn protection.

Understanding these industrial applications of silver is important because if there’s, for example, a higher demand for solar energy, which accounts for 10% of silver demand, the price of silver will increase. New medical applications for this metal or more electric cars will also generate greater demand for silver and other metals. Each electric car contains up to 3 kg of silver in its components. The demand for silver, therefore, comes from the following sectors:

– Health;

– Electronics;

– Energy;

– Jewelry;

– Automobiles.

The reason there is 20 times more silver than gold on our planet is due to the way these precious metals formed. Silver, for those who don’t know, isn’t created underground like oil (check out my article on oil when you finish this). The silver we see today was created billions of years ago when stars with 8 times more mass than the Sun reached the end of their cycle and exploded into supernovae.

Most stars, like the Sun, have a smaller mass than what is needed to create heavy metals. In other words, all the silver on our planet was created in a supernova billions of years ago, arrived in our solar system along with other elements, and mixed into the Earth’s crust.

The reason there is 20 times less gold on Earth is that gold (atomic number 79) is created in an even rarer event than a supernova: after a star collapses into a supernova, it becomes a neutron star, and when two neutron stars collide, even more extreme conditions of temperature and pressure are generated, and the electrons of atoms fuse into even heavier elements, such as gold and uranium (92 on the periodic table).

The Rarity Makes the Price

So, part of what makes something more or less valuable to humans is how scarce that element is. Silver depends on a supernova to emerge, and much of the silver on the surface of our planet has already been extracted. This attracts investors to have a portion of their wealth in silver, as it is a good store of value.

It is estimated that there are 2 million tons of silver on Earth, with three-quarters already mined, and 90% of all silver has been extracted, consumed, and even discarded.

The unit of measurement for precious metals is the ‘troy ounce,’ which equals 31.10 grams. So, for example, an ounce of gold, or 31 grams of gold, costs around $1,800, platinum’s ounce is $900, and silver’s is $30. Each material has its price and is traded with its derivatives.

Physical Asset: Metal Bars

There are several ways to invest in metals, from buying physical silver bars, which have a higher cost in both purchase and storage. For some, silver is not just an investment; it’s a store of value. Let’s say the government starts printing a lot of money, and inflation skyrockets; those who have silver can protect themselves in such a situation.

But if I buy a silver bar and leave it in my house, it’s just lying around, I might lose it in the midst of my clutter, or it could be stolen if someone breaks into my house. So when we talk about investing in silver, most of the time we’re talking about opening your computer and logging into a trading platform.

Financial Asset: Derivatives and ETFs

If I want to engage in short-term operations, day trading, I would trade a derivative like silver. But if I wanted to invest for the long term, I might look for an ETF.

In other words, we don’t trade physical silver; as a trader or investor, 99% of the time, you’ll deal with financial instruments, potentially using leverage, or trading short, i.e., profiting from the decline in the price of silver. It’s funny how you can make hundreds of thousands of dollars in profit trading silver without ever actually having physical contact with this precious metal.

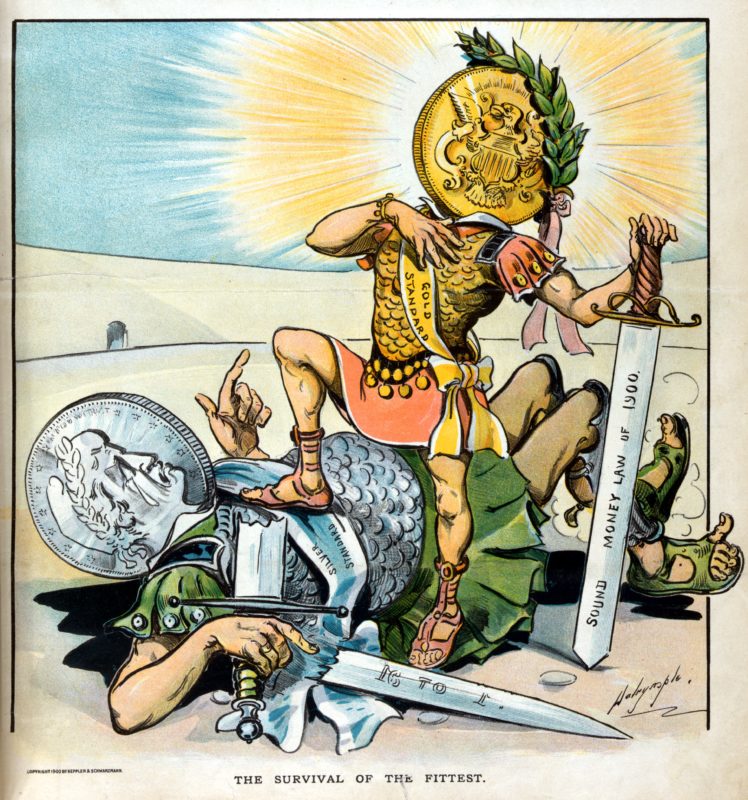

The Dollar and the End of the Gold Standard

I almost forgot to mention that until 1965, each dollar coin still contained a small amount of silver. The issuance of the dollar was tied to a certain amount of silver and gold that the government held in its reserves, at a gold-silver ratio of 15:1. Because these metals were scarce, it gave more confidence that the government would not print as much money as it wanted and generate inflation.

Only throughout the 20th century was the monetary base, which is the amount of money in circulation, gradually decoupled from silver and gold, especially after the end of the gold-dollar standard in 1971, when money became fiduciary, relying on people’s faith and trust rather than being backed by precious metals.

Silver: The Enemy of Interest Rates

But why is silver the enemy of interest rates, as I mentioned at the beginning of the video?

In general, the higher a country raises interest rates to contain inflation, the more incentive investors will have to withdraw their money from metals like silver and invest in assets that yield interest. Since silver does not pay interest, the higher the interest rates, the less attractive it is for investors to allocate their money into silver.

Ah, but the stock market also becomes less attractive, yes, but at least there are stocks that will be generating dividends for the investor; silver won’t yield anything. Either you profit from price fluctuations, or at least you protect yourself from excessive inflation, as we’re seeing with the currency in Argentina.

Additionally, silver is more sensitive to interest rates, as an increase in interest rates increases the debt burden of companies that use silver, thereby reducing demand for the metal.

Defending Your Portfolio with Precious Metals

Gold, in times of economic uncertainty, is sought as a store of value, and in cases of inflation and a breakdown in confidence in the economy, there will be more demand for gold as a safe haven, causing its price to rise. Meanwhile, a slowing economy will reduce demand for silver and increase demand for gold, causing changes in the gold-silver ratio.

A metal like silver functions in your portfolio defensively, as something that maintains its value over time, regardless of inflation of fiat currency, and it’s not something that will increase your portfolio by 300%. It’s protection. You won’t get rich from silver appreciation, but you also won’t become extremely poor if your government goes overboard with money printing; silver will preserve your wealth.

Who Produces and Who Consumes Silver

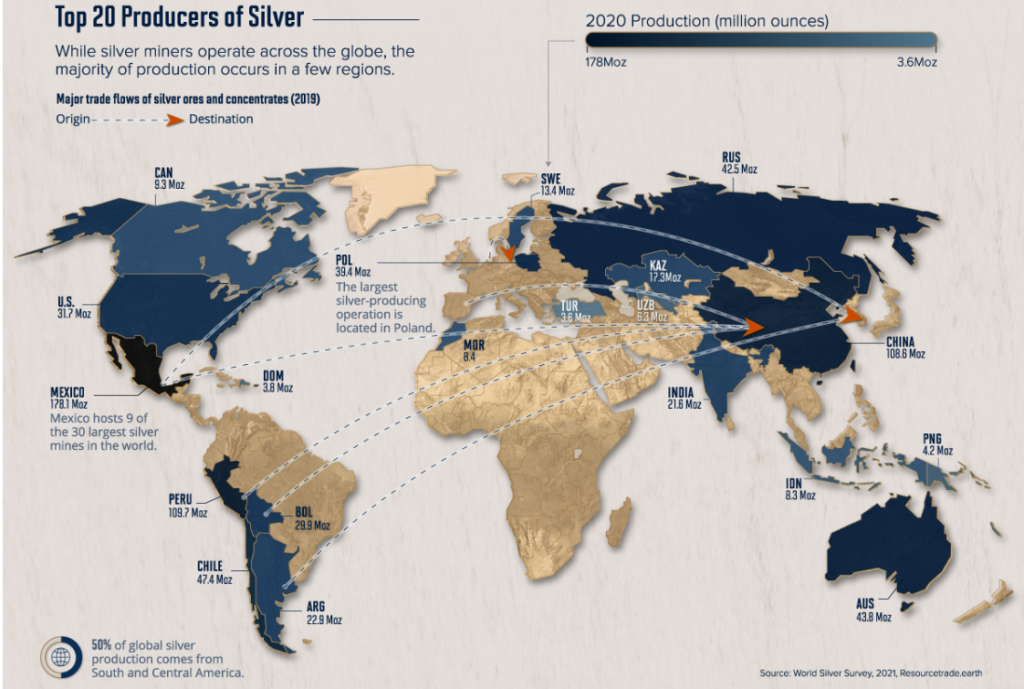

Currently, the world’s largest producer of silver is Mexico, with 6,600 tons/year, representing 20% of global production. Next are Peru and China, with 4,000 tons each, followed by Russia and Poland with less than 2,000 tons per year each. Mexico and Peru remain among the largest sources of silver on the planet.

Some of the largest silver mining companies in the world are Mexican, such as Penoles and Fresnillo. Canada is also home to some of the largest mining companies globally. This market doesn’t have seasonality like agricultural commodities

Check out my video on silver with stunning visuals of this metallic commodity:

>> See also:

One Response