Oil is the most traded commodity in the world. Today, anyone can profit from the fluctuation of oil prices using a computer or cellphone. In this article, you will learn everything about oil for investment and trading. However, this is not a recommendation for you to buy or sell oil; I will simply provide a series of data about this market, which are highly relevant for anyone looking to trade oil or simply gain a better understanding of this crucial market.

Let’s explore metrics of the oil market and how it has become a key player in our economy, and why its price impacts both your pocket and your investments.

The World’s Biggest Commodity

Of the 100 million barrels of oil traded daily, ⅔, or 70 million barrels, are of the Brent type. A barrel of oil contains 42 gallons, almost 160 liters, and 30 billion barrels are produced annually. Many futures contracts also rely on Brent to manage risks. Governments use this price to set tariffs, so you pay more or less for everything you consume due to the fluctuation of Brent’s price.

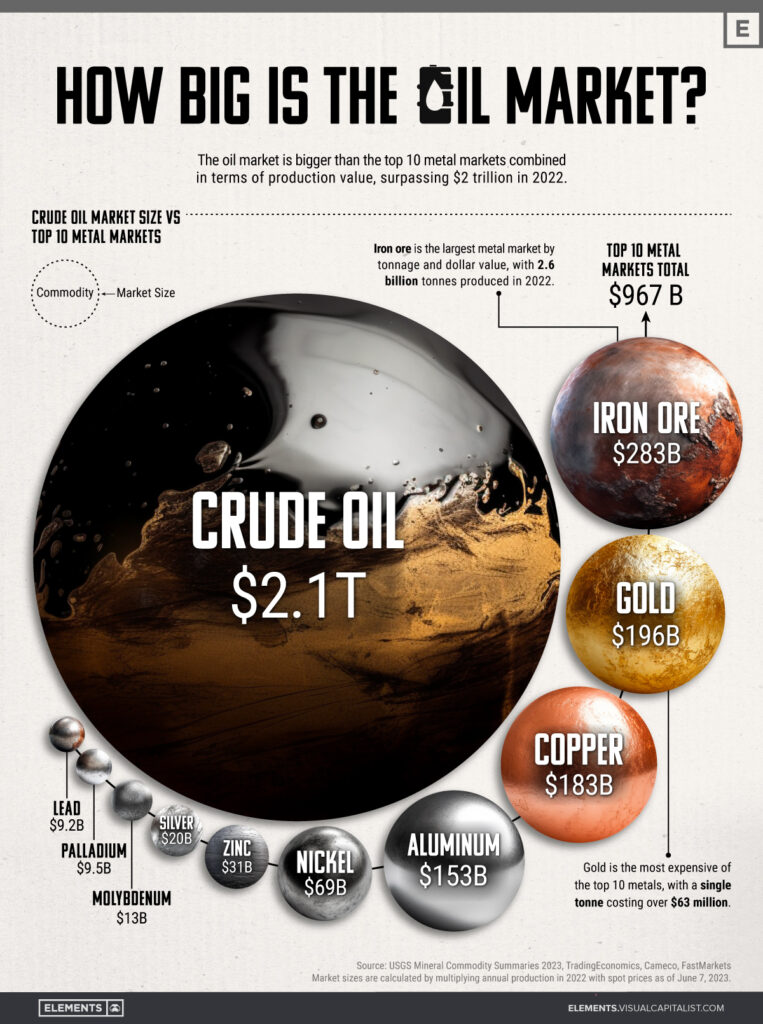

One-third of all energy consumed in the world still comes from oil, so it’s no wonder that this is the most traded commodity in the world: $2 trillion is traded every year out of the $88 trillion that make up the global GDP. If you add up the top 10 metal markets in the world, such as iron ore, gold, etc., you don’t even reach half of what is traded in oil.

This is a highly liquid market, and a commodity that rivals the largest stock indices in the world. If you’re considering investing in oil for the long term, it makes sense to understand the basics of its history.

From Divine Fire to Fuel

Since ancient times, peoples of the Middle East, such as Persians and Egyptians, knew crude oil and even revered it as divine fire, used in temples and balms, or as a sealant for ships. The ancients didn’t know it, but that oil they revered is the result of high pressure and temperature on the remains of beings that lived hundreds of millions of years ago, before the dinosaurs.

However, it wasn’t until 1859 that Edwin Drake drilled the first commercial oil well in Pennsylvania, United States, where there is now a museum in his honor. At that time, oil had little economic significance, but it was already lubricating machines, and kerosene was replacing whale oil in lamps, which even helped save some whales from extinction.

By the end of the 19th century, advancements in oil research, in areas such as medicine, materials science, and especially fuels, revealed the energy potential of oil and elevated it to the status of the world’s most important commodity, the black gold of the 20th century, the century of oil.

Petroleum Derivatives

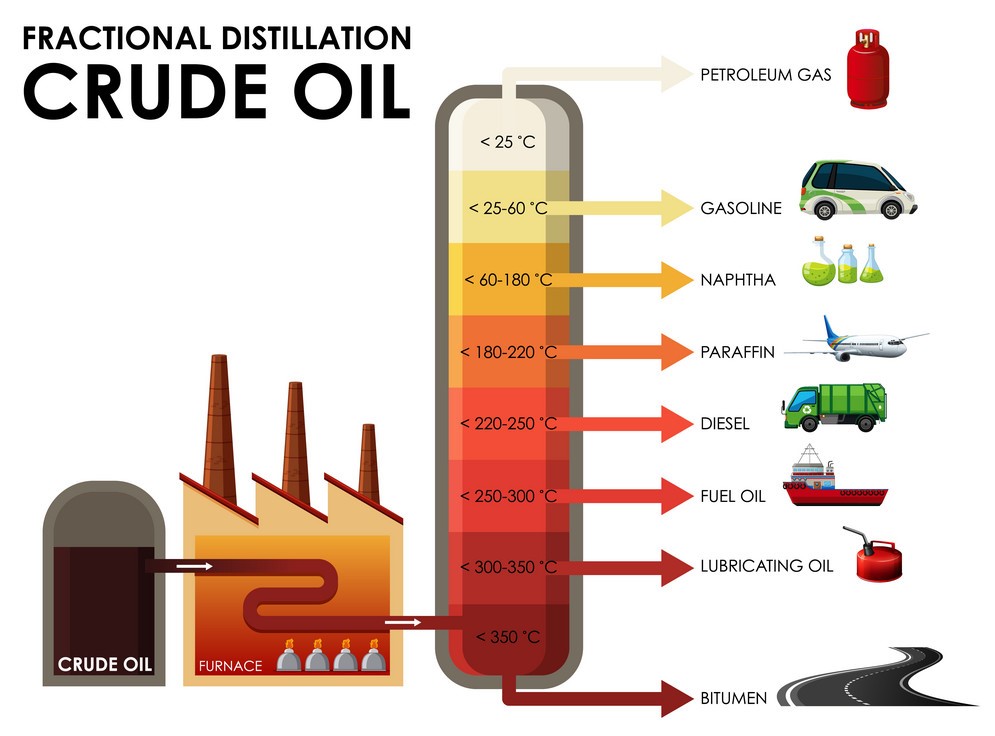

Today, thousands of products we use in our daily lives have petroleum as their raw material, such as fuels, lubricants, plastics, chemicals, fertilizers, synthetics, asphalt, medicines, cosmetics, paints, solvents, prosthetics, chewing gum, among others. In other words, this is an indispensable product for modern life, which is music to an investor’s ears.

When you hear that the economy is growing, you can be sure: the demand for oil, and therefore its price, will rise accordingly. And if your country’s currency appreciates against the dollar, oil becomes more accessible for you. Oil is a key player in the macroeconomic and geopolitical chessboard.

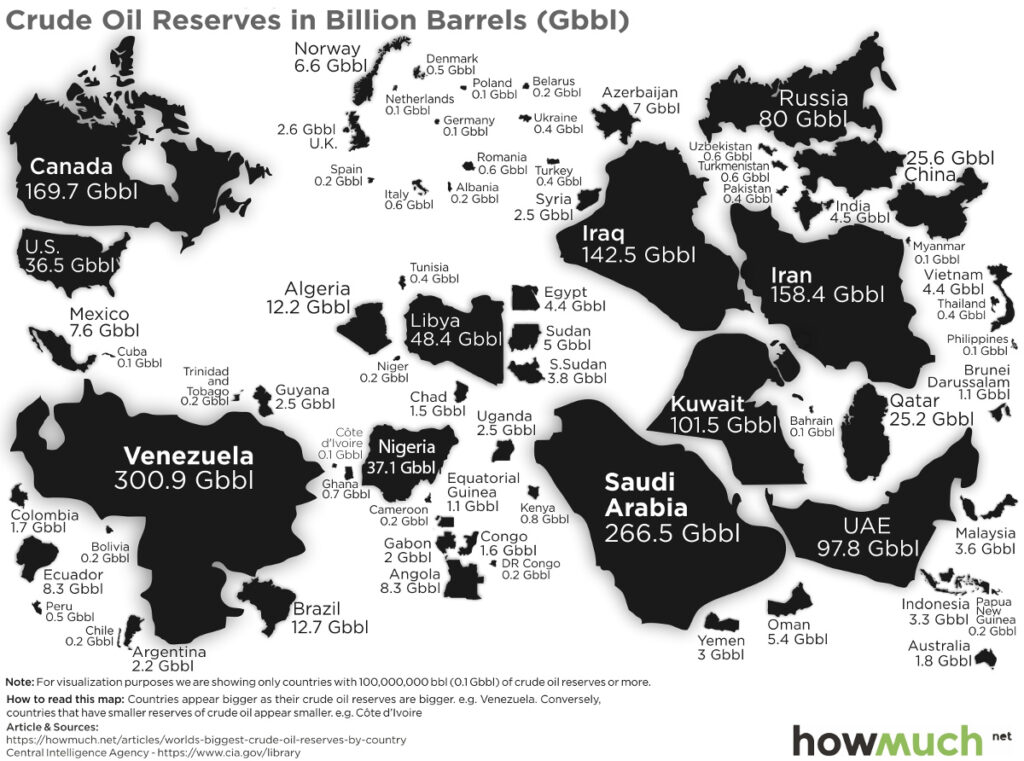

The Largest Oil Reserves

Despite the differences in viscosity and sulfur content that exist between the oils from each well, any extracted oil will find a market and impact the prices of Brent and WTI, which are the two standards of this market, and which you can trade on a trading platform of your choice. Oil is present all over the world, but in some regions with more abundance and better quality, such as North America, the Middle East, and Russia.

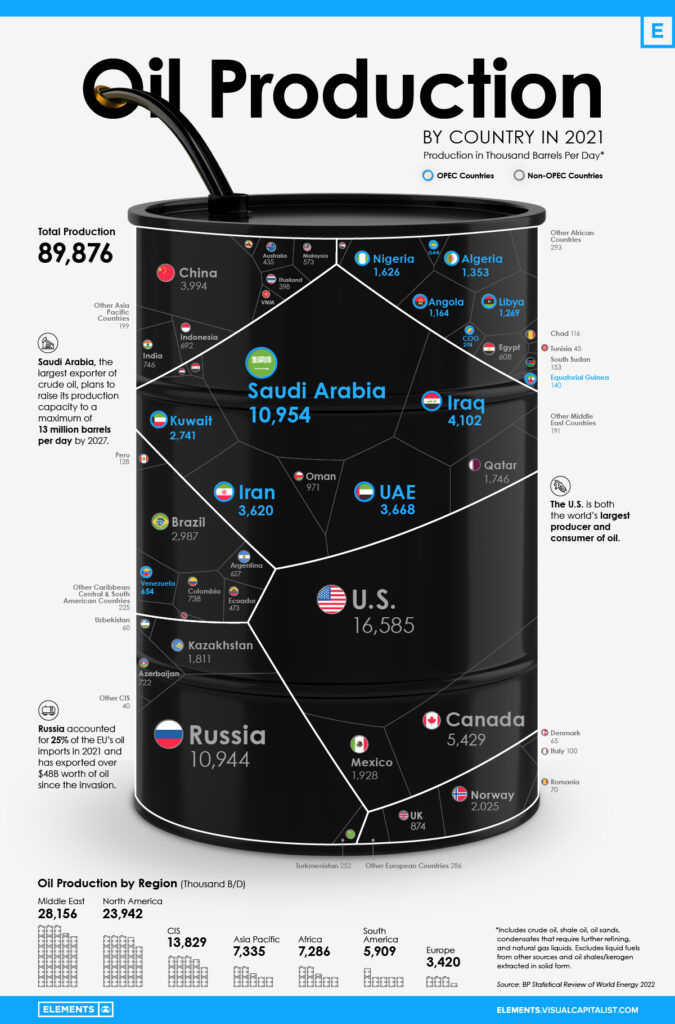

In the last decade, the United States sought to develop shale, an unconventional oil, and became the world’s largest oil producer, averaging 16 million barrels per day, well ahead of Russia and Saudi Arabia, with 11 million barrels per day each. Brazil is in the top 10 largest producers, with about 3 million barrels per day.

When an oil reserve is discovered, this oil is extracted along with natural gas and groundwater, and at the extraction site, separation is made between these products. Then the crude oil is transported by pipelines, ships, or tanker trucks to refineries, where impurities such as sand and sulfur are removed, and the oil begins to be turned into fuels and asphalt.

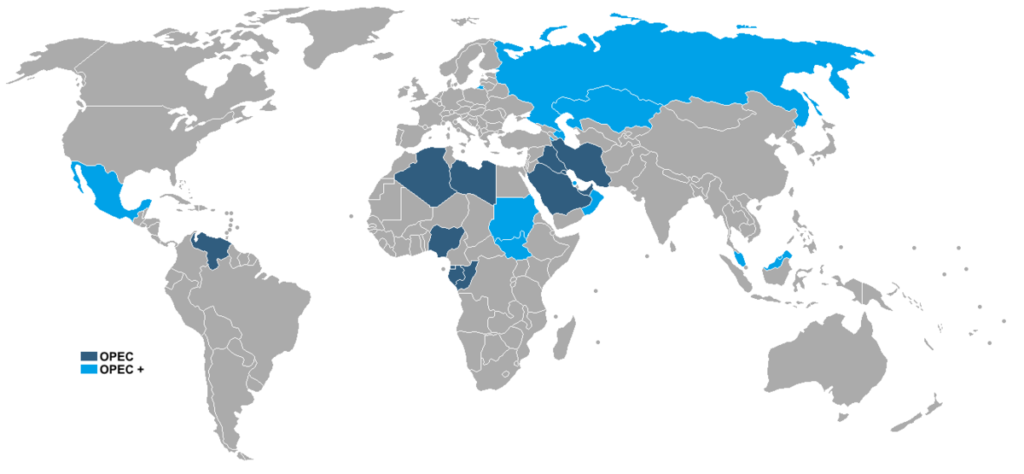

OPEC and Geopolitics: The Curse of Oil

One of the advantages that oil had over coal is its high energy density, which allows for the transportation of large amounts of energy in a relatively small volume, enabling the rise of the automobile culture in the 20th century. The discovery of the first oil well in Saudi Arabia in 1938 led this country, which was one of the poorest in the world, to now derive over 90% of its revenue from oil. This enabled them to gain disproportionate influence in geopolitics, especially after the founding of OPEC, the Organization of the Petroleum Exporting Countries.

OPEC was established in 1960 by the major oil-producing countries, from the Middle East to Venezuela, to coordinate their production and pricing policies, and it created situations like the 1st Oil Shock in 1973. In that year, the price of a barrel of oil rose from $3 to $12 after OPEC declared an embargo on oil sales to countries that supported Israel in the Yom Kippur War. Then we had a 2nd oil shock after the Iranian Revolution in 1979 and the Gulf War in 1990; indeed, much of the conflicts of the 20th century involved oil.

Many oil-producing countries fell into the so-called “oil curse,” facing challenges such as corruption and excessive dependence on oil, such as Venezuela, Angola, and several others. It’s worth noting here that Venezuela’s current situation is not solely due to its abundant oil reserves; that’s a fallacy. It is in its current state due to socialist disaster.

The Two Types: Brent and WTI

Brent crude oil is the type of oil extracted in the North Sea, between England and Norway. It is low in sulfur and easy to refine, making it the most important price benchmark for oil investors or traders. Over the past 40 years, it has become the primary benchmark for oil prices. Three-quarters of the world’s crude oil is priced based on Brent, making it the largest commodity market in the world.

The second-largest market in the world also belongs to oil, but of another type, West Texas Intermediate (WTI), which is the oil of the United States. Both Brent and WTI are highly liquid markets, and both have a positive correlation with economic growth. When the economy grows, the demand for oil increases, which drives up its price. And if we increase production, the price of Brent and WTI falls. That’s what Saudi Arabia did in 2014 when it flooded the global oil market to lower prices and thus break American shale producers, the opposite of what it had done in the 1st oil shock.

1st Way to Invest: Oil Company Stocks

You can expose yourself to the oil market in various ways. Investors can select stocks from companies like ExxonMobil (XOM), Royal Dutch Shell (RDS-A), British Petroleum (BP). There are also Brazilian companies like Petrobras (PETR4), Prio (PRIO3), 3R Petróleo (RRRP3). However, for long-term investment, you would need to monitor the data of these companies and the oil sector as a whole. Thus, there are simpler ways to expose yourself to oil and profit from price fluctuations.

2nd Way to Invest: Derivatives

Traders who want to trade oil use derivatives, instruments linked to the price of oil, whether Brent or WTI. These derivatives allow leverage, meaning you don’t have to allocate all your capital in a single transaction because you can use the margin offered by the brokerage. Therefore, the asset that the trader chooses is different from what a long-term investor would choose.

Only trade oil if you understand the risks involved. You can either gain a lot or lose a lot. It’s up to you to define your strategy and risk profile, always use stop-loss to limit losses. There are oil derivatives that allow you to trade outside of regular trading hours, with markets open 24 hours a day, allowing you to operate both long and short positions, and utilizing leverage.

The Oil Market Reports

In the oil market, it’s crucial to stay informed with weekly and monthly reports that indicate the supply and demand dynamics in the market. Among the key reports that I recommend are:

1. EIA (Department of Energy): The United States Department of Energy publishes weekly petroleum inventories. If petroleum stockpiles are increasing, indicating an excess supply, prices are likely to fall.

2. OPEC: The Organization of the Petroleum Exporting Countries releases monthly reports on global oil balances.

3. IEA (International Energy Agency): The IEA also publishes excellent reports and forecasts on the oil market.

4. Private groups such as Baker Hughes: Every Friday, Baker Hughes releases the rig count, which provides insight into drilling activity.

During the first one or two minutes after the publication of these reports, there is usually increased volatility, and often they may diverge from each other. Therefore, always form your own opinion, knowing that this market is heavily influenced by expectations, the dollar, and geopolitics. A variation of 5 million barrels per day, for example, is expected. If it exceeds this significantly, be attentive, as there may be a non-recurring event. This is a market where prices respond greatly to expectations.

The Oil Calendar

In terms of seasonality, oil production isn’t as affected as other commodities, such as agricultural commodities. However, demand for oil typically increases towards the end of the year, during the northern hemisphere’s winter, and in the middle of the year, during the summer when travel tends to rise.

If you’re considering investing, it’s essential to pay attention to these factors. However, if you’re trading, don’t worry too much about these seasonal trends. Instead, focus on the economic calendar to see if there are any relevant data releases that could impact oil prices on a given day.

This market is also influenced by the price of the dollar: when the dollar weakens, oil becomes cheaper regardless of whether production has increased. With oil being cheaper, it tends to stimulate demand.

Check out my video analyzing oil price charts for more insights:

2 Responses