In this article, you’ll discover essential information about the natural gas market: its usage, top producers, and how to invest in the world’s second-largest energy commodity.

Natural gas is a non-renewable fossil fuel, alongside coal and oil, accounting for a quarter of global energy production. Every year, approximately 4 trillion cubic meters of natural gas are extracted, representing a market worth $1 trillion. While it’s half the size of the oil market, the natural gas market has been significantly impacted by pandemics and conflicts in recent years.

This commodity serves three primary purposes: powering thermal power plants for energy production, serving as a raw material in industries for manufacturing plastics, fertilizers, and chemicals, and used in vehicles and residential settings.

GNV, or Natural Gas Vehicle, is a viable option for vehicles that cover over a thousand kilometers per month, offering fuel savings of up to 40% compared to gasoline.

In residential usage, natural gas is utilized for heating homes and offices in colder regions. In countries with large urban centers, natural gas pipelines deliver gas directly to households. However, in smaller towns, liquefied petroleum gas (LPG) is more common for household use, distinct from the natural gas discussed in this context.

How the Gas is Extracted

Natural gas can be found isolated or near coal or oil reserves, and it is formed in the same way: animal and plant remains are subjected to intense temperature and pressure for hundreds of millions of years, turning into a gaseous hydrocarbon.

This gas is extracted and refined to remove water, sand, and other residues, to be piped in a gaseous state through pipelines or cooled to -123º C to become LNG, liquefied natural gas, as in its liquid state it has a volume 600 times smaller and is transportable by ship.

War in Europe and the Price of Gas

Since February 2022, Europe has virtually stopped receiving gas from Russia, its largest supplier for decades, and has started to rely on liquefied natural gas brought by ship from Asia and America, which greatly stimulated the construction of infrastructure at ports for this liquid form of natural gas.

However, the supply shock was so significant that the price of gas reached highs in August 2022, prompting its substitution by coal and other energy sources, which eventually lowered the price of gas afterward.

In Europe alone, the demand for natural gas dropped by 1.5%, or 55 billion cubic meters, a decline similar to the first wave of Covid, also resulting from a mild winter.

3 Factors That Affect the Price of Gas

The price of natural gas tends to rise with colder winters in the Northern Hemisphere, between December and March, and weather conditions can also delay gas production if there are hurricanes or storms in the production areas.

In addition to weather, we can cite three more factors that impact the price of natural gas:

1. Storage:

Natural gas can be stored underground, and the larger the reserves, the lower the price will fall, discouraging new production.

2. Economic growth:

Like any energy commodity, if the economy grows, industries will demand more natural gas, causing the price to rise.

3. Substitutes:

The cheaper coal or oil are, the more they will be preferred over natural gas, despite it being less polluting than the other two. In Italy, for example, more than half of the energy comes from natural gas, while in Poland, less than 10%.

Who Produces and Who Consumes Gas

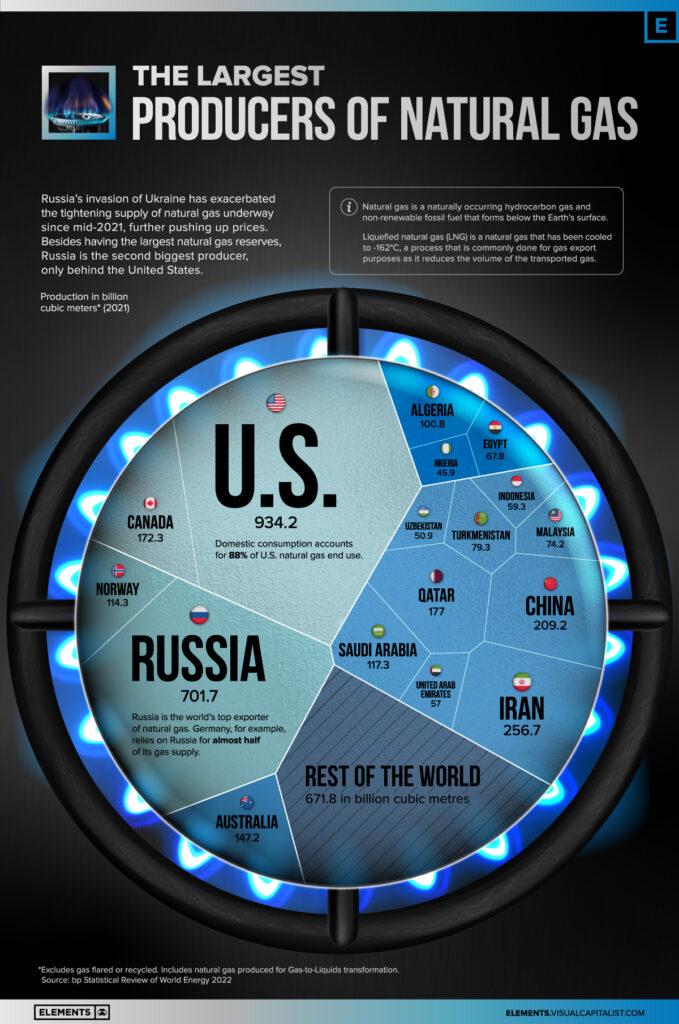

The United States is the world’s largest producer of natural gas, accounting for a quarter of global production, nearly 1 trillion cubic meters per year, with almost 90% used domestically.

Russia is the second-largest producer, with 750 billion cubic meters, of which 200 billion are exported, making it the world’s largest exporter, followed by Iran, China, and Qatar. Qatar is now the largest exporter of liquefied natural gas (LNG).

The largest natural gas-producing companies are naturally from the producing countries: Gazprom and Rosneft from Russia, PetroChina and Sinopec from China, ExxonMobil and Chevron from the United States, along with British Petroleum and Royal Dutch Shell. Exxon and Shell are known as good dividend payers in this sector.

How to Invest in Natural Gas

All of these are also major oil producers, with the difference that the natural gas market has grown by more than 2% annually in the last decade, much more than oil, and most of the gas is used in the country where it is produced, while in oil, ¾ is traded between regions. The largest consumers of natural gas are the United States, Russia, and China.

In addition to directly investing in stocks of companies in this sector, you can also use ETFs to have exposure to natural gas in your portfolio. On the American stock exchange, there is UNG, which since 2007 invests in natural gas futures contracts, or FCG, which brings together 40 natural gas companies, and you can find BDRs on the B3.

Check out my video on natural gas: