Investing in the cattle market can offer an interesting opportunity for portfolio diversification, especially considering its relevance and global scale. With nearly 1 billion head of cattle in the world, it’s evident that the sector plays a significant role in the global economy. Brazil, as one of the countries with a large cattle population, stands out in this market.

The cattle market is vast, with an estimated value of around 500 billion dollars and an annual growth rate of approximately 5%. Most of this market is dedicated to the production of meat for human consumption, but it also includes dairy production, such as milk, cheese, and ice cream. Additionally, cattle by-products like leather, gelatin, chewing gum, and even piano keys and buttons contribute to the diversity and scope of this market.

Investing in cattle can be a way to diversify your portfolio, taking advantage of commodity volatility and even protecting against inflation. There are various financial instruments available to invest in this market, and many of them can be accessed through mobile apps, making the investment process more convenient and accessible.

It’s important to note that this article is not intended to provide investment recommendations or promote specific brokerages. Its aim is to provide relevant information to help you make your own investment or trading decisions. The cattle market, particularly the beef futures contract, can be suitable for day trading, swing trading, and position trading, depending on your goals and investment strategies.

The Life Cycle of Cattle

The life cycle of beef cattle consists of three phases: breeding, rearing, and fattening, and the products generated in these phases are, respectively: calf, feeder cattle, and fat cattle. It all begins with the breeding cows, giving birth once a year.

The calf is born weighing between 30 to 40 kg and for the next 8 months, it feeds on maternal milk and begins to graze. Weaning occurs around 100 kg, when they enter the rearing phase, and they graze for another 6 to 10 months until they reach over 200 kg, at which point they can be found in auctions and in the financial market under the name ‘feeder cattle’.

In the second year of life, they go to feedlots, where, with proper nutritional supplements and veterinary care, they will exceed 500 kg and become fat cattle, or ‘live cattle’, with different specifications from feeder cattle in the market. Generally, the fattening period lasts from May to October, when fat cattle are ready to be received by slaughterhouses.

Importante Cattle Markets

Another major trading center is the CME, the Chicago Mercantile Exchange, where the live cattle contract is for 40,000 pounds, roughly 18 metric tons, with contracts expiring every two months. Notice that it’s different from Brazil, where the contract is smaller and expires every month, and it’s also different from the feeder cattle futures contract, as well as agricultural commodities, which only expire in certain months of the year.

A third important trading center for live cattle is the ASX, the Australian Securities Exchange, which also has its own conditions for the live cattle futures contract. Therefore, you need to gather information about the specific asset you intend to trade.

Who Produces and Who Consumes Cattle

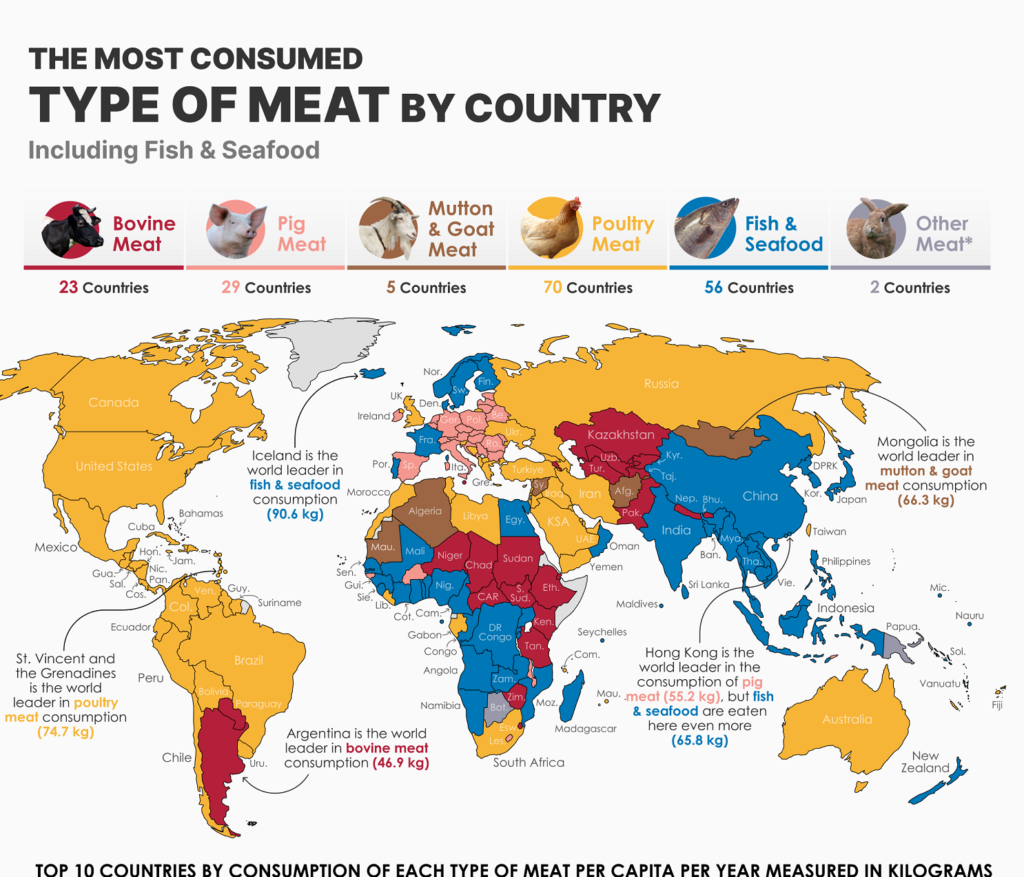

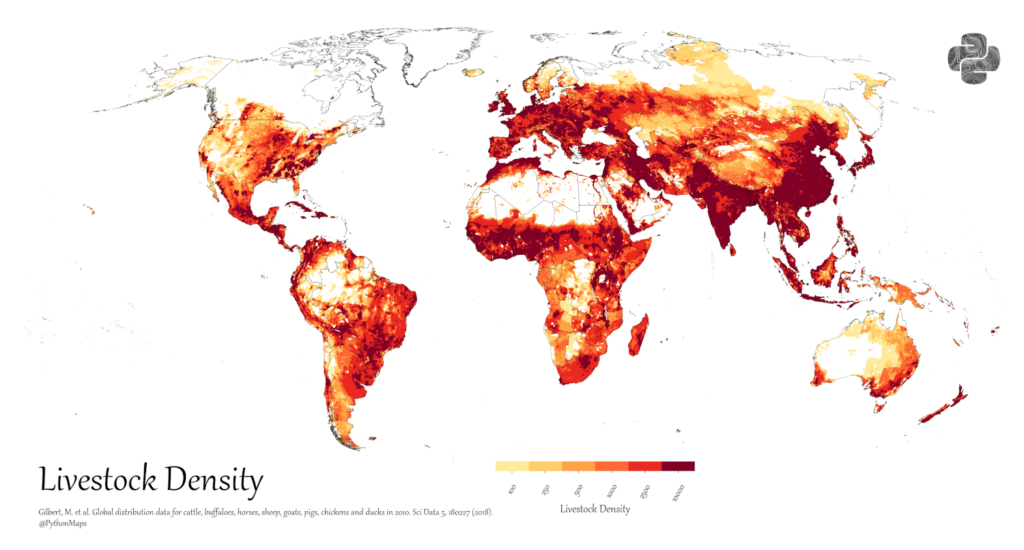

Let’s dive into the numbers of cattle production around the world. Of the nearly 1 billion cattle globally, one-third reside in India, where the majority of citizens do not consume these animals as cows are considered sacred. However, the water buffalo, known as the “búfalo d’água,” faces no religious restrictions in India, and Indians are the fifth-largest meat producers in the world. Brazil boasts the second-largest cattle herd, representing 20% of the global bovine population, followed by China and the United States, each with 10%.

In terms of meat production, the annual output is approximately 60 million tons, with the United States leading at 12 million tons, followed by Brazil, the European Union, China, India, and Argentina. However, since meat consumption correlates with income levels, the United States primarily consumes its domestic production, making Brazil the world’s largest exporter with 2.7 million tons, nearly double what the United States exports, with Australia, India, and Argentina following suit.

Regarding the fact that four countries have more cattle than people, these nations are Uruguay, Argentina, Brazil, and New Zealand. As for meat consumers, the United States leads the pack, followed by China and Brazil. Among the largest importers are China, South Korea, and Russia.

4 Factors Affecting Live Cattle Prices

Now that you know where beef cattle are produced and consumed, let’s consider 4 key factors that influence the price of live cattle and the risks associated with this market:

1. Population and Economic Growth: The more people there are in the world and the higher their income, the greater the demand for meat. When the economy is struggling, people tend to switch from beef to poultry and pork, causing beef prices to decline.

2. Climate and Agricultural Harvest: The cattle market is minimally related to other markets, except for grain markets such as corn and soybeans. If there’s a drought, it drives up the cost of grains used as cattle feed, leading to higher beef prices. However, if many farmers sell their cattle to avoid the higher grain prices, the price of live cattle drops. The price relationship between cattle and corn is dynamic and can be exploited by traders.

3. Environmental Trend: Given that beef production requires significant water and land resources, younger consumers have been seeking to reduce red meat consumption. Consequently, significant market growth is anticipated primarily in Asia, especially in China.

4. BSE, Bovine Spongiform Encephalopathy: The disease known as “mad cow disease” is constantly monitored and can disrupt markets whenever there’s suspicion. In March 2023, a single sick animal in Pará blocked all Brazilian beef exports to China, but exports resumed promptly after it was confirmed to be an isolated case.

Understanding all these production and consumption factors, as well as the inherent risks, is essential for leveraging opportunities and profiting from the live cattle market. I have a playlist on the channel exploring these patterns for other commodities as well, including some that affect live cattle prices, such as corn and soybeans.

3 Advantages of Trading Live Cattle

Trading the live cattle commodity offers several advantages for traders or investors:

1. The first advantage is that this market is generally uncorrelated with fixed and variable income. It follows its own logic, with long and well-defined price trends, high leverage, and liquidity, which favors those who understand technical analysis.

2. The second advantage is that this is an excellent market to hedge against inflation: suppose prices are rising due to strong inflation, your barbecue is more expensive, but when you open Xstation 5, you’re making money because you’re long in this market.

3. Live cattle futures allow you to stop just spending money on meat and start profiting from cattle appreciation, which brings a third major advantage of diversifying your portfolio in this particular market.

3 Tactics for Investing in Live Cattle

Here are some tactics you can adopt to profit from live cattle without even owning a farm:

1. You can invest in a commodity basket that includes cattle, metals, and energy. This way, you will benefit from both economic growth and recession.

2. Alternatively, you can trade assets that are not directly exposed to the price of live cattle futures, such as stocks and ETFs in the sector. Some of the largest meat processing companies in the world are Brazilian, such as JBS, Marfrig, BR Foods, and Minerva, which would also indirectly expose you to this market.

3. A third tactic commonly used in this market involves spreads between the price of feeder cattle and live cattle futures, or even between physical cattle found in auctions in regions like Mato Grosso, Goiás, or any other production area, and the price of cattle in the futures market.

This is widely used, even by hedgers, participants in the physical market, to make investment decisions, and can also be used by speculators like yourself, engaging in day trading in the cattle market.

Check out the video I made about the commodity live cattle: