The assets we invest in or trade are financial products, but they represent tangible goods in the real world, so their prices move according to natural disasters, wars, and geopolitical risk.

The greatest example of this is the Oil market. Fortunes have been made and lost as storms hit global Oil routes.

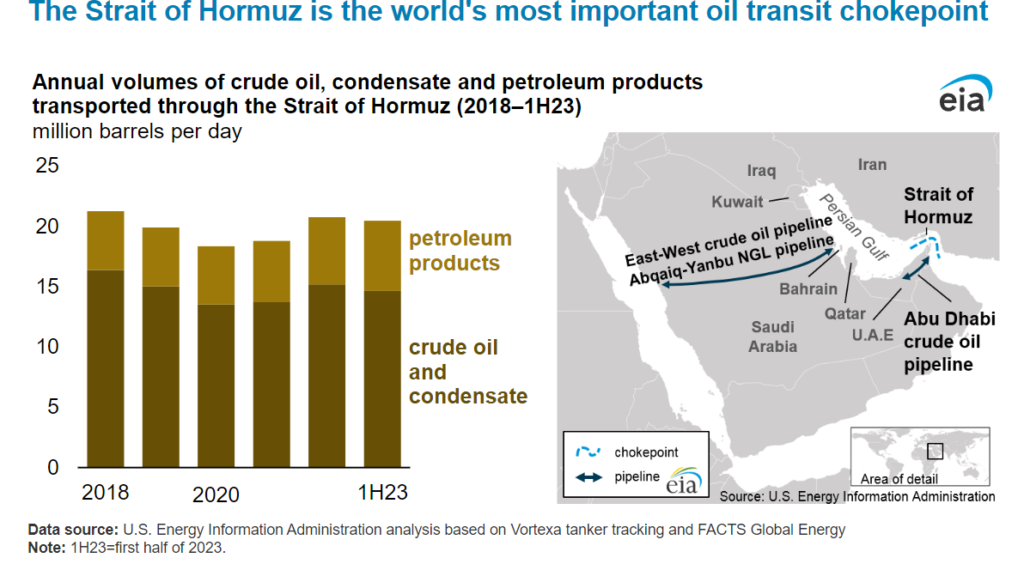

The Strait of Hormuz, located between Oman and Iran, connects the Persian Gulf with the Gulf of Oman and the Arabian Sea, and is considered the largest bottleneck, or chokepoint, in international trade, as one-third of the Oil transported by sea worldwide passes through it.

1/5 of the global oil goes through the Strait

The Strait lives up to its name: at its narrowest point, it is less than 40km wide. In 2023, the average flow of Oil through the Strait of Hormuz was 21 million barrels per day (b/d), or 21% of the global consumption of crude oil.

There are other significant chokepoints in global trade, such as the Strait of Malacca in Asia, and the Suez Canal in Egypt, but none are as crucial as the Strait of Hormuz.

The inability of Oil to transit through there, even temporarily, would cause significant supply delays and increase transportation and energy costs worldwide.

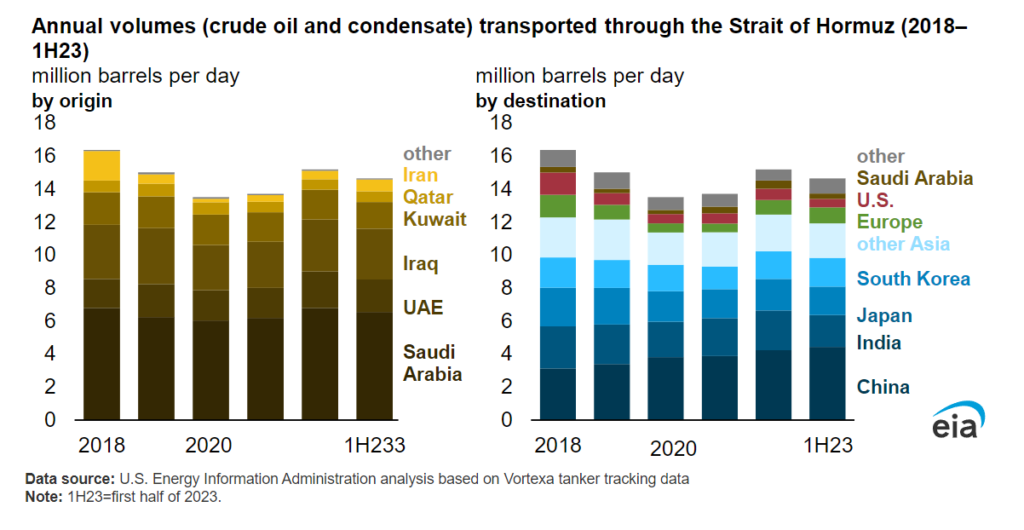

Despite 80% of the Oil passing through there being destined for Asian countries, such as China, India, Japan, and Korea, inflation would be impacted everywhere if ships carrying Chinese goods could not leave ports due to fuel shortages.

Trade as a pressure weapon

This risk exists and is anthropogenic, of human origin: one of the world’s largest Oil producers and a regional power in the Middle East, Iran, has threatened to block the passage of the Strait of Hormuz for several decades.

In a quick search on YouTube, you’ll find news from 12 years ago, 5 years ago, or 2 weeks ago.

This has been a trump card for the Iranian regime, which would hardly be able to sustain a long blockade, as the country itself depends on food imports through the Strait, and there would be significant pressure from countries that export Oil through it, such as Saudi Arabia, United Arab Emirates, Kuwait, and Qatar, besides Asian customers.

Geopolitical risks and returns

As investors and traders, we need to understand the risks and opportunities in different scenarios. In a case like this, there would be volatility in the stock markets, which is beneficial for traders, especially in Oil, energy, and maritime transportation stocks and ETFs, and assets that protect against inflation, such as gold and bonds.

Of course, this is not investment advice, just a conjecture of geopolitical risks, especially regarding the world’s largest commodity: Oil.

Check out the video:

There’s a video on the channel solely about this market, worth $2 trillion a year, from a global GDP of $88 trillion:

>> See also: