Cotton is the world’s most important natural fiber, found in 1/3 of all clothing. 25 million tons are produced annually, in a $40 billion market. In this video, you’ll learn everything about this market: where it’s produced and consumed, what factors impact its price, and how to invest and trade cotton from the comfort of your home.

This is one of humanity’s oldest commodities: it has been used for over 7,000 years, from Mexico to India. It was the raw material that propelled the Industrial Revolution and remains the world’s largest non-edible crop, with 2% of arable land dedicated to it.

Cotton Cultivation and Its Uses

This is because cotton is a versatile fiber: it’s washable, dyeable, and, of course, comfortable to wear. Two-thirds of the cotton produced is used to make fabrics: denim, T-shirts, bedding, curtains, as well as various products like gauze, coffee filters, tents, and fishing nets. Its seed also serves to produce feed and cholesterol-free oil.

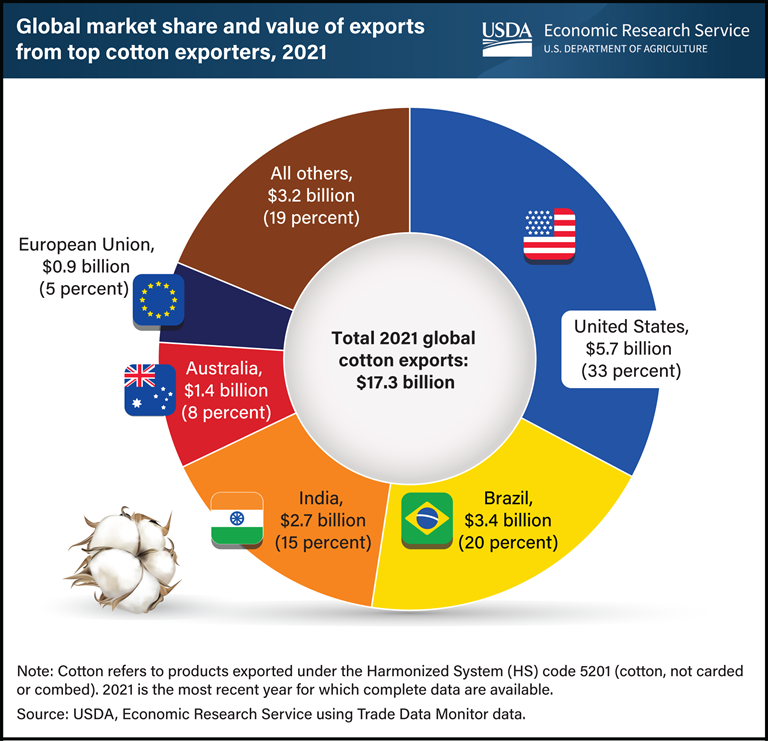

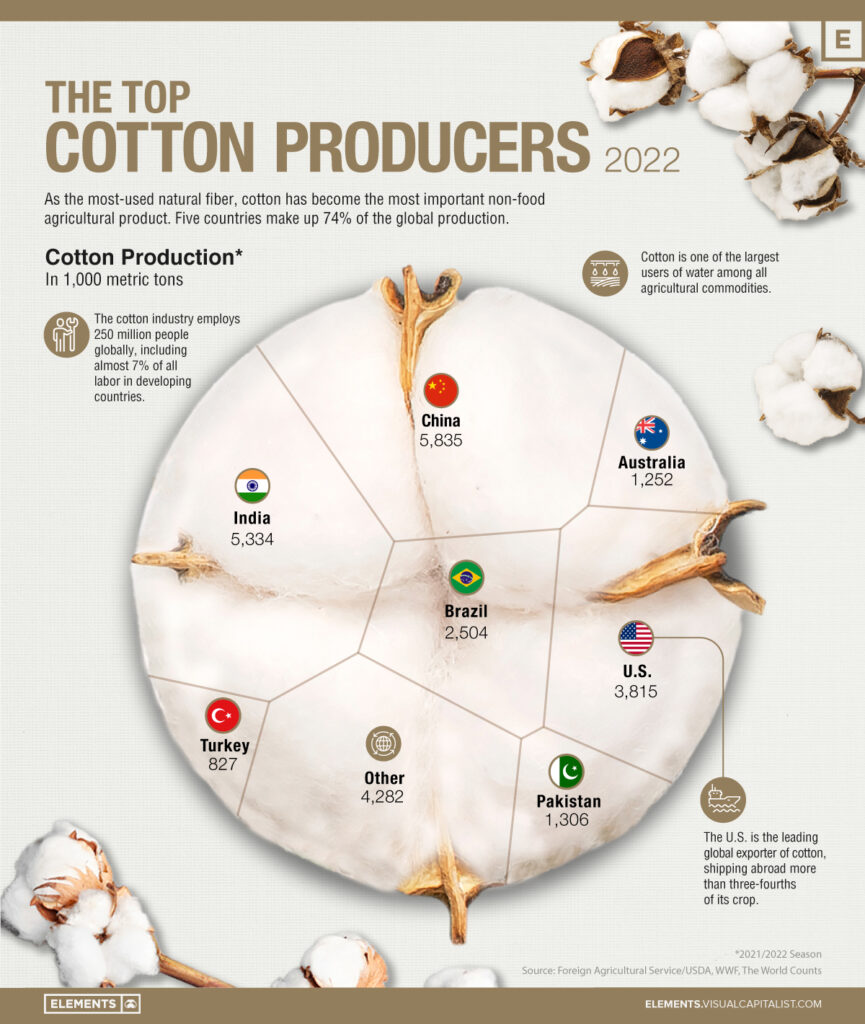

The cotton plant is a shrub that grows in tropical and subtropical regions, and 65 countries around the world cultivate it, but half of all cotton is produced in just 2 countries: China and India. The United States and Brazil follow closely, each with about 12% of the world’s production, and they are also the largest exporters of cotton, since a large portion of China and India’s production is consumed domestically.

The Global Cotton Market

I’ll show the cotton chart later on, but I need to emphasize that this article is not a recommendation to buy or sell cotton, and it’s by no means a recommendation of a platform or broker. However, I have to show a chart, so I’ll display the chart from the platform I prefer.

This is an extremely important industry in developing countries, especially in Central Africa and Southeast Asia, with 350 million people around the world making a living from this sector. China alone has over 100,000 cotton farms and 7,000 textile factories.

The Chinese are also the largest importers of cotton, absorbing 17% of global production. Next come the major clothing producers, Bangladesh and Vietnam. The global garment industry is estimated at 1.3 trillion dollars. Did you catch that tongue twister?

Three sad tigers swallowing wheat. Okay, back to business, seriously, 1.3 trillion dollars excluding footwear, and most of that comes from cotton, which, after harvest, is compressed into bales weighing 218 kg each. The world consumes 112 million bales per year. Each bale produces about 200 pairs of jeans or 1,200 T-shirts.

3 Price Factors

There are three main factors that impact the price of this commodity:1. Political: Governments of cotton-producing countries artificially keep cotton prices low by subsidizing their farmers and by establishing strategic reserves which, when released, can drive prices down.

2. Economic: Like all commodities, the price of cotton rises when the dollar strengthens, and it fluctuates according to supply and demand dynamics. Additionally, synthetic fabrics such as polyester, nylon, and elastane pose challenges to cotton as substitute goods.

>> Also see: Dollar vs. Commodities

3. Climatic: Agricultural commodities like cotton are vulnerable to droughts, wildfires, and floods. The more issues there are in production, the lower the supply and the higher the price. In a year of good harvest, there will be ample cotton available, causing prices to fall.

Companies and Funds in the Sector

This is a market dominated by large companies, so you can gain exposure to cotton by investing in stocks of companies in this sector. In Brazil, for example, there’s SLC Agrícola, Brasil Agro, and Terra Santa. Internationally, there’s Cargill, Archer Daniels (ADM), and Louis Dreyfus (LDC).

In addition to investing in stocks, you can also invest in ETFs. The largest ones are BAL by iPath and COTN by Wisdom Tree, which track a cotton subindex from Bloomberg, and BALB, which aggregates cotton futures contracts. Actually, a more direct way to invest in cotton would be through the futures market or using other derivatives.

Because buying stocks is less direct, right? Even though you’ll have exposure to cotton by buying stocks in companies in this sector, obviously, the most direct way is by speculating on the price of cotton itself. I’ll be doing a technical analysis of the cotton chart soon, so stay tuned.

Suppliers and Customers

Another option to expose yourself to cotton, albeit more indirectly, is by investing in companies that provide machinery and seeds to the agricultural sector, such as John Deere and Monsanto, which has been owned by Bayer since 2018, one of the largest companies on the German stock exchange.

And if you want to bet on the decline in cotton prices, you can invest in those who buy this raw material, such as the world’s largest apparel companies: Ralph Lauren, Levi Strauss, H&M, and PVH, which owns Calvin Klein and Tommy Hilfiger.

None of this is a recommendation to buy or sell any asset; I’m just laying out the players in this market. An interesting fact is that the price of cotton more than tripled when the pandemic broke out until mid-2022.

Watch the video for more details: