Every year, 5 million tons of cocoa are produced, generating over $15 billion in revenue, not to mention the $100 billion chocolate market. In this article, you will understand how cocoa has become one of the most coveted commodities on the planet, with 80% of production concentrated in a small region of the globe.

This market is so vast that you can find cocoa derivatives on investment and day trading platforms, accessible to anyone, even those just starting out in the market with limited available capital.

Let’s delve into everything about this market, from the cocoa cycle, cultivated in tropical regions, to its transformation into chocolate in northern countries. We’ll discuss the risks of this market, but please note that this is not a recommendation to buy or sell cocoa. The goal is to understand this market, gathering numbers and data to help you make your own investment decisions.

And stick around until the end to learn how to make money with cocoa by trading through your computer or mobile device.

The cocoa tree is a tropical plant

Cocoa is a tree that begins to bear fruit four years after planting, which already sets it apart from other agricultural commodities like corn and soybeans, which are annual plants: sown and harvested in the same year. Cocoa, on the other hand, is a perennial plant that produces fruit for several years and throughout the year, making it a market with less seasonality.

It is a tropical plant that thrives in warm and rainy areas, up to 20 degrees north or south of the equator, and its value as a commodity lies in its seeds. After harvesting, the seeds are left to ferment, during which about 10 beans from each fruit detach from the white pulp and are left to dry in the sun.

After a few days, the cocoa beans are ready to be transported to factories, where they will be roasted and ventilated to form cocoa nibs. You can already find these in stores, but most of them are pressed to produce cocoa liquor.

The Cocoa Liquor and Cocoa Butter

This is the first significant byproduct of cocoa, and it can be further separated into two parts: one solid part, which is ground into cocoa powder, and another pasty part containing the fruit’s fat, which is cocoa butter. The entire cocoa market is based on these three products: cocoa liquor and its two byproducts: cocoa powder and cocoa butter.

All three of these ingredients are mixed with powdered milk and sugar to achieve the final goal, which is chocolate. For every kilogram of chocolate, about 500 cocoa beans are used, which translates to approximately 50 fruits.

Where Does All the Chocolate Go

The majority of the world’s cocoa is used to make the famous chocolate, but a portion is also used for its moisturizing and antioxidant effects, found in shampoos, soaps, therapeutic products, and the pharmaceutical sector. The cocoa market is estimated to be worth $15 billion, in addition to the chocolate market itself, which is in the range of $100 billion, with an annual growth rate of about 4%.

Most chocolate is sold during festive seasons such as Christmas and Easter. The countries that produce the world’s most well-known chocolate brands are naturally the largest importers of cocoa. This includes German brands like Milka and Kinder. By the way, have you seen the price of a Kinder egg? Also, Swiss brands like Nestlé and Lindt, and American giants like Hershey’s and Mars. Europe and Russia alone represent 40% of the chocolate market.

The Ones Behind Chocolate

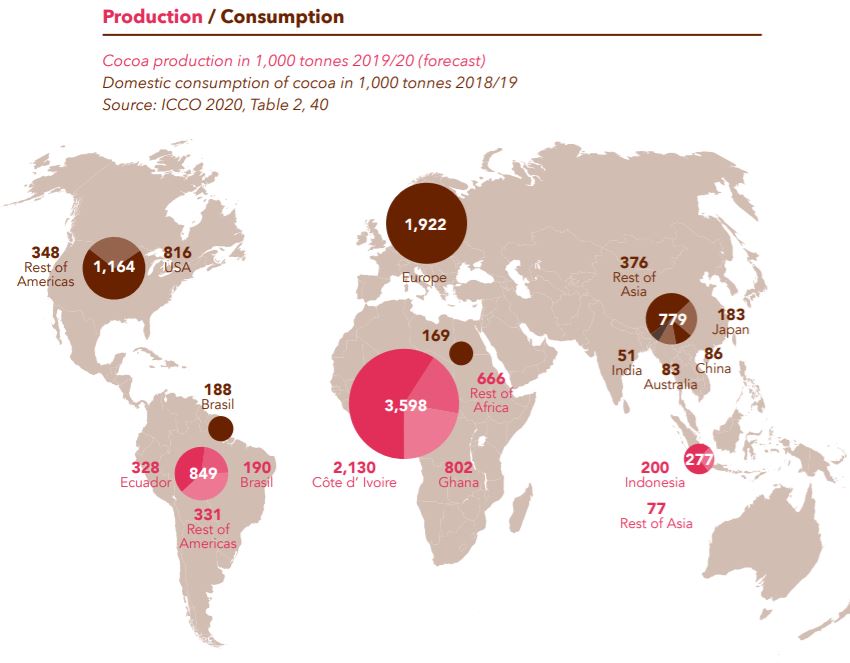

The world produces 5 million tons of cocoa annually, marking a 50% growth between 2000 and 2020. 80% of the world’s cocoa production comes from West Africa, with countries like Ivory Coast, Ghana, Cameroon, and Nigeria leading the way. Another 15% of cocoa comes from South America, mainly from Ecuador and Brazil. The remaining 5% is produced in Oceania, including countries like Indonesia and Papua New Guinea.

The majority of cocoa producers are small rural families, spread across 6 million farms worldwide. Remarkably, 70% of the world’s cocoa crop comes from just two African countries: Ivory Coast and Ghana. Ivory Coast alone produces 2 million tons per year, representing 40% of the world’s cocoa.

If you’re considering investing in cocoa or simply buying and selling through an investment platform, stick around until the end, as I’ll show you the practical side. But first, let’s delve into the history of this commodity to make this the definitive text on cocoa.

The History of ‘Xocoatl’

While the largest cocoa production currently takes place in West Africa, this plant is native to Mesoamerica. In the hot and humid tropical forests of southern Mexico and Honduras, extending to Venezuela, you can still find wild cocoa. Five thousand years ago, it was already known to the peoples of the Yucatan Peninsula, such as the Olmecs and the Mayans, who considered it a divine substance used to make sacred and aphrodisiacal beverages.

Hence, when Carl Linnaeus himself coined the scientific name for cocoa, he called it Theobroma cacao, meaning ‘food of the gods’ in Greek, and ‘cocoa,’ derived from the Aztec word for the plant and its derivatives: ‘kakahuatl.’

When Europeans arrived in 1500, cocoa was known and cultivated throughout the tropical zone of the Americas, where its seeds served as currency among various indigenous peoples, and the beverage made from it was popular across the continent, known as ‘xocoatl.’

Chocolate was holy but without sugar or milk

A Spanish soldier who participated in the conquest of Mexico with Hernán Cortez recounts that Montezuma, the last Aztec emperor, and 2,000 nobles would always have a drink served in a golden cup for dinner. It was ‘xocoatl’: cocoa with vanilla and other spices.

When the Spanish tasted that beverage, they liked it and brought cocoa to Europe. There, they decided to mix it with sugar and milk, creating the modern chocolate industry. In the 19th century, the development of cocoa powder and chocolate bars contributed to chocolate ceasing to be a luxury item and becoming popular across all social classes.

80% of Cocoa Comes from Africa

With 80% of cocoa now coming from West Africa, its price is highly exposed to conditions in this region of the globe, whether they be climatic, such as droughts and floods, or agricultural pests, to instability and political conflicts. Recently, above-average rainfall led Ghana to produce 140,000 tons less of cocoa.

This market follows the common mold of the commodities market, where we trade derivatives from the comfort of our homes. I think it’s worth quickly recalling here how the commodities market works:

A commodity is a raw material, of agricultural or mineral origin, that is widely traded in the global market. As this product gains consistent supply and demand, standards are created for trading this commodity anywhere in the world.

Cocoa Futures

In order for cocoa producers and chocolate factories to hedge against price volatility, they fix purchase and sale prices in advance through what are called futures contracts. In the case of cocoa, futures contracts began to circulate after World War II.

A third step after a raw material becomes a commodity, and commodities turn into futures contracts, and probably the one that interests those watching this video the most, is when people who do not participate in the physical trade of cocoa start trading that commodity through trading platforms.

Cocoa traders can speculate on the future price of cocoa, aiming to profit from price trends, whether they are upward or downward. To trade cocoa, or any other asset, you need to have a pre-defined operational strategy and manage risk through stop-loss and position sizing.

Check out the video I made teaching how to trade cocoa on a trading platform: