At this time of year, many uninformed traders rush to retrieve their full-year Brokerage Statements from the previous year and start searching on Google for “how to calculate the average stock price.”

This is because by May 31st, every Brazilian investor in variable income, among others, is required to submit their DIRPF, the Individual Income Tax Return.

But I’m here to inform traders or investors that you don’t need to fulfill vows by calculating the average price to determine profits and offset losses from the three types of operations (common, REITs, or day trading), nor subtract the fees and taxes to fill out your monthly DARF.

The easiest way to declare taxes today

All of this is a thing of the past; nowadays, there are free tools that calculate your monthly DARF and even show the values to fill in your annual declaration, in addition to totaling your dividends.

It’s the BTG Income Tax Calculator, a free tool for those who invest through the largest investment bank in Latin America and a partner here on the channel.

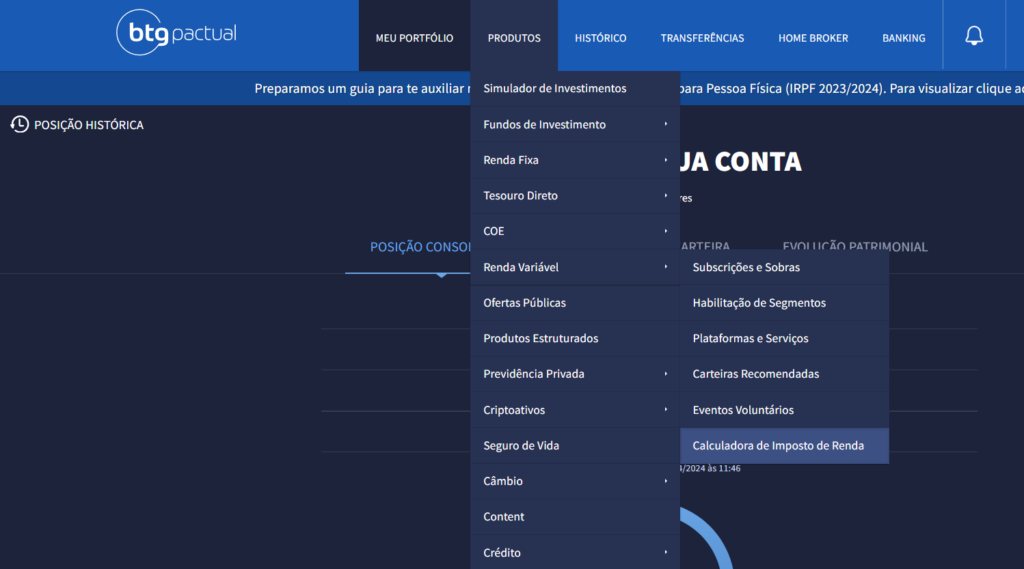

You access your BTG Investment Account and go to:

Products > Variable Income > Income Tax Calculator

This is an amazing tool, and it’s worth bringing your investments to BTG just for this feature. It even allows you to input your assets from another brokerage to generate a DARF for just that month.

Just 3 tabs will help you throughout the year

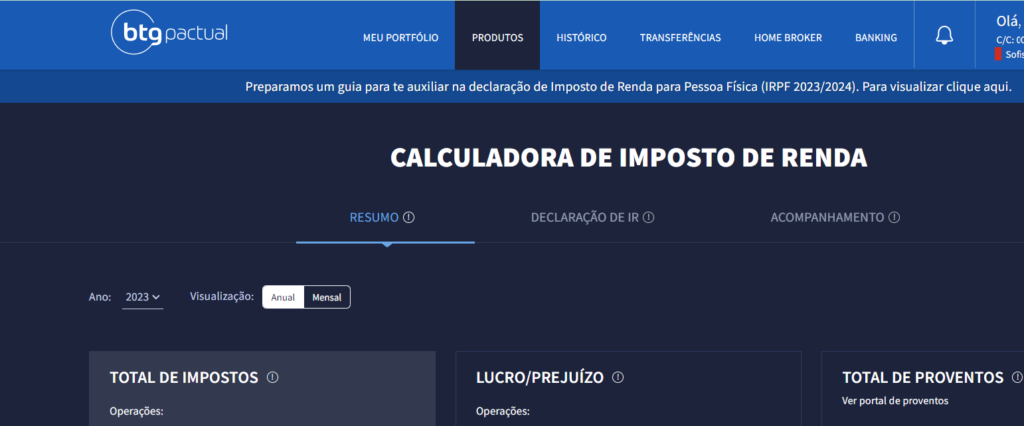

It’s easy to use, with 3 tabs:

Summary:

which shows how much profit or loss you made in a month or a year, and the total amount you have to pay in taxes for the 3 types of operations, in addition to ‘Earnings’, which shows how much you received in dividends;

IR Declaration:

In this tab, you will see all the values to fill in your annual Income Tax return. Here you can generate a file to export to the Revenue Service Program, or just view the numbers to fill in under ‘Assets and Rights’ and ‘Taxable or Tax-Exempt Income’.

Monitoring:

In the 3rd and last tab, you can track the summary of your operations: how much profit you are making and how much tax you owe, or if you have losses to offset.

The IR Calculator is free

So, the IR Calculator is a fundamental tool for you not to have to calculate on your own to declare your income tax annually and to issue your monthly DARF. Here in the description will be the link for you to use the IR Calculator and my other article explaining how to fill out the monthly DARF.

-> Check out the video: