The physical gold ETF is a commodity traded on the stock exchange, an ETC in English acronym, which seeks to replicate the performance of the gold price, providing investors with direct exposure to the precious metal.

The main characteristic of this type of asset is that it is backed by real gold, which means the fund holds gold bars in a vault as its underlying asset, rather than futures contracts or other financial derivatives.

It offers the opportunity to invest in gold without needing to store the metal yourself, which would entail higher transaction costs and security concerns.

More than 200 tons of Physical Gold

Physical gold ETCs, such as IGLN.UK or SGLN on other platforms, are popular among investors looking to hedge against inflation, diversify their portfolio, or seek a safe haven in times of uncertainty, which gold provides, but without the costs involved in storing bullions yourself.

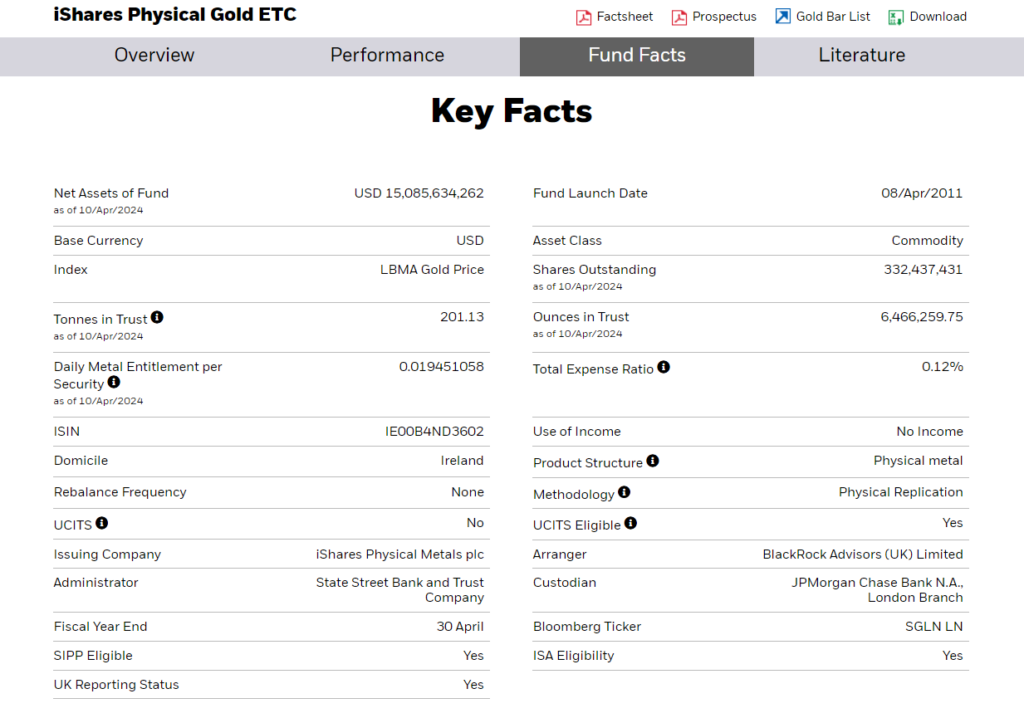

The bars of a physical gold ETC are stored in vaults and are audited periodically. In the case of this one, there are over 200 tons under the custody of JP Morgan and managed by State Street, the issuer of SPDR ETFs (spider). The gold bars back the issued securities and are valued daily by the London fix price, which is the center of gold trading worldwide.

ETC is like a Commodity ETF

An ETC is essentially a commodity ETF, with a small difference in securitization, their financial architecture: the ETC is structured as debt securities backed by commodities, and the ETF as an exchange-traded fund, but in practice the ETC functions much like a commodity ETF, and in this case, it’s 100% allocated in physical gold.

As they are exchange-traded funds, they offer liquidity and ease of trading without the need to directly deal with the storage and physical transportation of gold, or pay the high fees of mutual funds, which were the more traditional funds in the market before ETFs emerged in the ’90s.

Look for the management fees of each ETF

It’s important for an investor interested in trading this or any other ETF to conduct their own research and understand the risks and costs of the fund before investing, such as associated fees and how it fits into their investment strategy, as this video is educational and not an investment recommendation.

There are several physical gold ETFs available, with the largest being the GLD from State Street. However, because it is the largest, it needs to hold more gold bars in stock and has a management fee of 0.40%. For this reason, I chose the IGLN.UK, which is the iShares physical gold ETF, with a fee of 0.15%, and [platform] charges zero commission.

It is listed in the UK, hence the ‘.UK’, but denominated in US dollars, and as the price of gold fluctuates in the market, the value of the ETF’s share moves accordingly, providing a convenient and liquid way to invest in gold.

Watch my video on physical gold ETFs for more information: