Today, you’ll learn about the business model and the numbers behind The Coca-Cola Company, the largest beverage manufacturer in the world. With 2.2 billion servings of its products consumed daily in 200 countries and its brand recognized by 94% of people, Coca-Cola is a powerhouse in the beverage industry.

You can easily trade the company’s stocks without leaving home, and I’ll guide you through how to do it.

The emergence of a legend

The original Coca-Cola was created in 1886 in Atlanta, southern United States, by pharmacist John Pemberton, as a refreshing tonic made from cola nuts and coca leaves, hence the name suggested by his accountant Frank Robinson, who also handcrafted the logo used to this day.

In just a few years, it was sold for the equivalent of $77,000 to another entrepreneurial pharmacist, Asa Candler, who established the Coca-Cola Company in 1892. Three years later, it was already being sold in every American state.

Legend has it that the formula for Coca-Cola is secret and kept in the company’s vault. But it’s just a legend; what set it apart from the beginning was the quality of its operations, with distribution in every corner of the planet, and unbeatable marketing.

The company invests $4.5 billion in advertising every year, and for over a century has run famous campaigns, such as those at Christmas, which defined the image of the modern Santa Claus, and the Coca-Cola logo is now recognized by 94% of people, one of the top 10 most valuable brands in the world, estimated at over $100 billion.

A hybrid business model

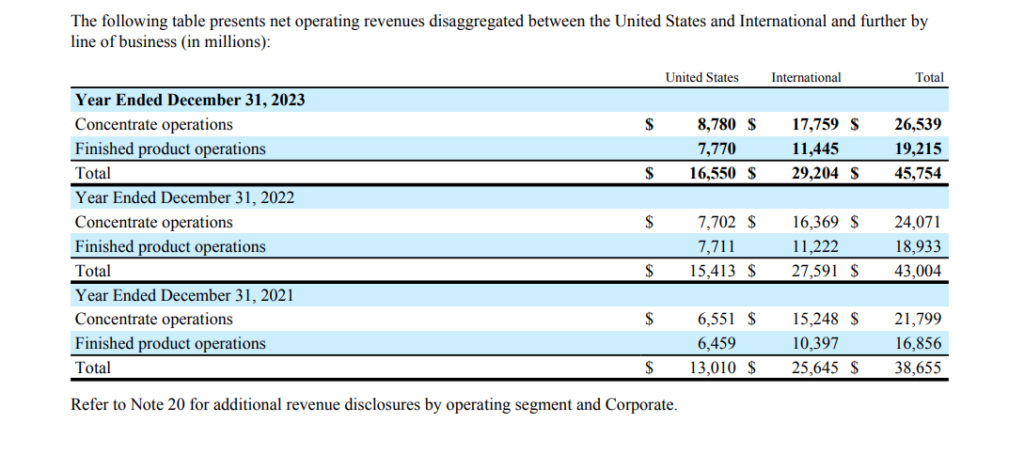

Coca-Cola’s business involves purchasing ingredients such as coffee beans, tea leaves, and fruit juices to manufacture concentrates and syrups, which are then sent to franchises to add water and carbonation and bottle the beverage. Half of the revenue comes from finished products and half from concentrates, which the company sells to authorized bottlers.

There are 225 partners worldwide, with 900 bottling plants. Coca-Cola initially controls both the operation and marketing, and as the factory establishes itself, the parent company gradually sells its stake to a franchisee.

Owner of over 20 billion-dollar brands

In addition to the Coca-Cola brand, the company owns more than 200 other brands, responsible for over half of its revenue, with 20 of them generating more than $1 billion annually. These include the soft drinks Fanta and Sprite, the sports drink Powerade, the energy drink Monster, Del Valle juices, Dasani water, and Costa coffee.

The company holds $26 billion in assets and ranks among the top 40 largest companies in the world, with a market value in April 2024 of $260 billion.

The most ubiquitous company in the world

Coca-Cola is a truly global company, operating in 200 countries, nearly double the presence of McDonald’s, which also has a video here on the channel, in the ‘Stocks’ playlist.

You can’t find Coca-Cola in only 2 countries in the world, the usual suspects: Cuba and North Korea, where even the ‘C’ in Coca has been collectivized.

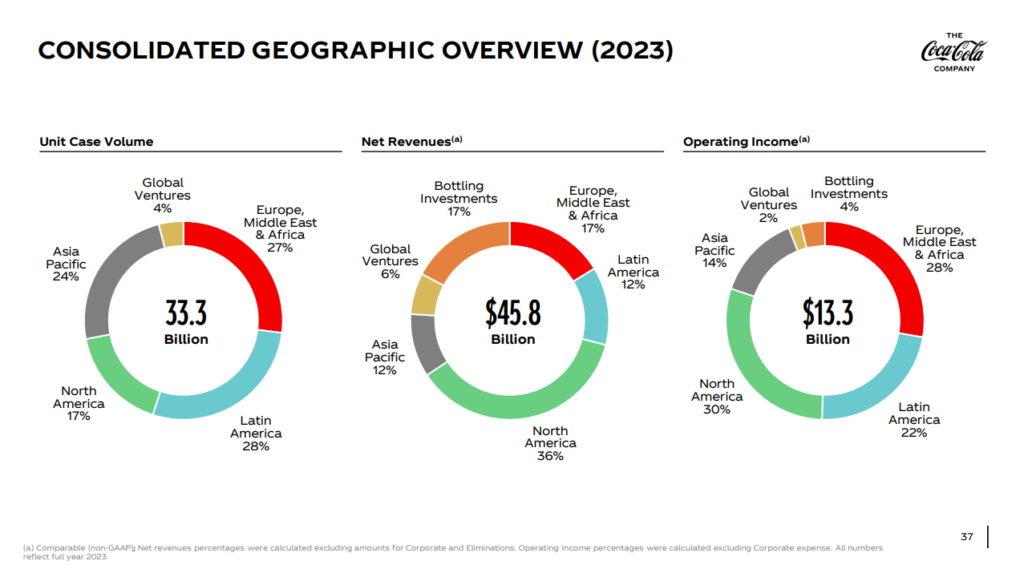

One-third of the company’s revenue comes from North America, but it is more profitable in other regions: Latin America contributes 12% of revenue, but 22% of Coca-Cola’s profit, with Mexicans being the biggest consumers of Coca-Cola per capita, almost twice as much as Americans.

Over 100 years on the Stock Exchange

In 2023, the company’s revenue was $45 billion, a 6% increase, with a net profit of $13 billion, resulting in a profit margin of 24%.

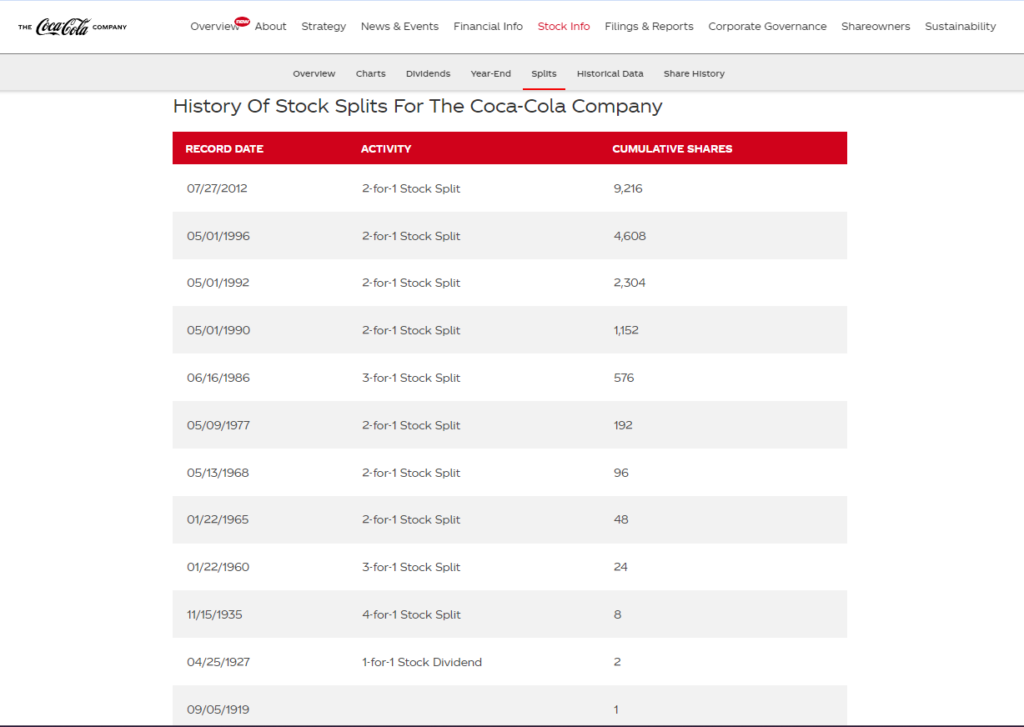

Coca-Cola made its debut on the Stock Exchange in 1919, with a bank receiving $100,000 at the time for the subscription of shares. This bank sold everything in 2012 for $2 billion, a return of 20,000 times, or 2 million percent, over 93 years, which adjusted for inflation gives nearly 11% per year.

One share at the IPO has split into over 9,000 shares today, after 11 stock splits, and the year following the IPO, the company began distributing dividends. In 2024, Coca-Cola has been increasing its dividends to shareholders for 62 consecutive years.

43% of non-alcoholic beverages belong to Coca

The Coca-Cola Company has 82,000 employees, but the Coca-Cola system employs 700,000 people, enabling over 2.2 billion servings of the company’s 355ml beverages to be served every day, capturing a 43% market share of non-alcoholic beverages worldwide. Its main competitors include Dr. Pepper, Nestlé, Red Bull, and its arch-rival, PepsiCo.

Warren Buffett’s side in the Cola Wars

The competition between the two became known as the Cola Wars, and Coca-Cola only fell behind when it introduced New Coke in 1985, changing the original formula of its flagship beverage. This move resulted in over 8,000 complaints per day and prompted the company to backtrack in less than 3 months.

This is because consumers grew up with Coca-Cola, and its products are associated in people’s minds with moments of camaraderie and pleasure, an area in which the company has pioneered marketing efforts.

Coca-Cola is such a “value investment” that Berkshire Hathaway, Warren Buffet’s company, bought nearly 10% of the company’s stock between 1988 and 1994 for $1.3 billion and received $75 million in dividends that year. They maintain the same position today and receive $700 million in dividends, nearly 10 times more.

Watch the video to see how The Coca-Cola Company’s stocks have performed: