ETFs, or Exchange-Traded Funds, are financial instruments that are increasingly popular among investors. This investment category has its own characteristics that make them suitable for both experienced and novice investors.

ETFs have particular characteristics:

Flexibility:

You trade ETFs directly on a platform, like any asset on the stock exchange.

Pricing: Since they are traded on the stock exchange, you can know the price of an ETF at any time, just like a company’s stock.

Low cost:

ETFs function like mutual funds, but with much lower management costs than traditional funds.

Transparency:

You know exactly what you’re investing in because all information about an ETF is readily available: which assets it holds, how they’re allocated, who the manager is, etc.

Diversification:

The main advantage of an ETF is that it allows you to diversify your portfolio. It’s unlikely that a small investor could, on their own, hold significant quantities of an asset with risk spread among them, whereas an ETF always includes various assets selected by experts.

ETFs emerged in Canada in 1990

This asset class reached $1 trillion in assets in 2009 and $6.5 trillion in 2018. That’s why I decided to start a playlist here on the channel about the best ETFs to have in your portfolio, automatically diversifying your investments and spreading your risk among various assets.

Nothing here is investment advice; this video is for educational purposes. We research various assets on this channel and gather information about them for you to make your own investment decisions.”

World Index by Morgan Stanley

“Today we’re going to talk about the world ETF, which replicates the MSCI World index. MSCI stands for Morgan Stanley Capital International, an investment research company that is publicly traded on the stock exchange and has been creating various indices for decades, grouping companies from the same sector or geographic region. Every year, they launch new indices, which are reviewed every three months and serve as benchmarks for the performance of assets or sectors, or for index funds, the ETFs.

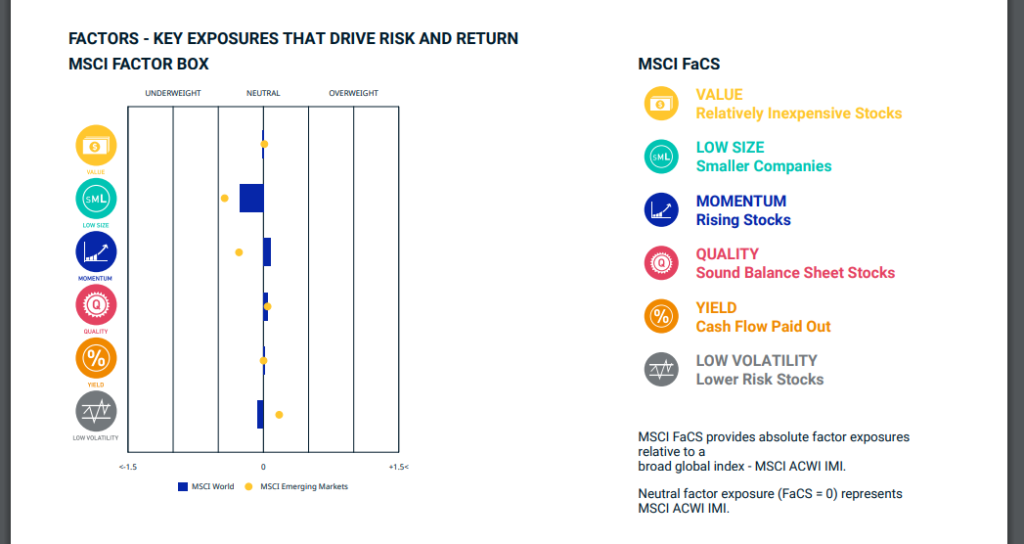

The MSCI World index measures the performance of large-cap companies with global presence in developed countries. So, it is used to describe how the stock market is performing on a global scale, excluding stocks from emerging countries.

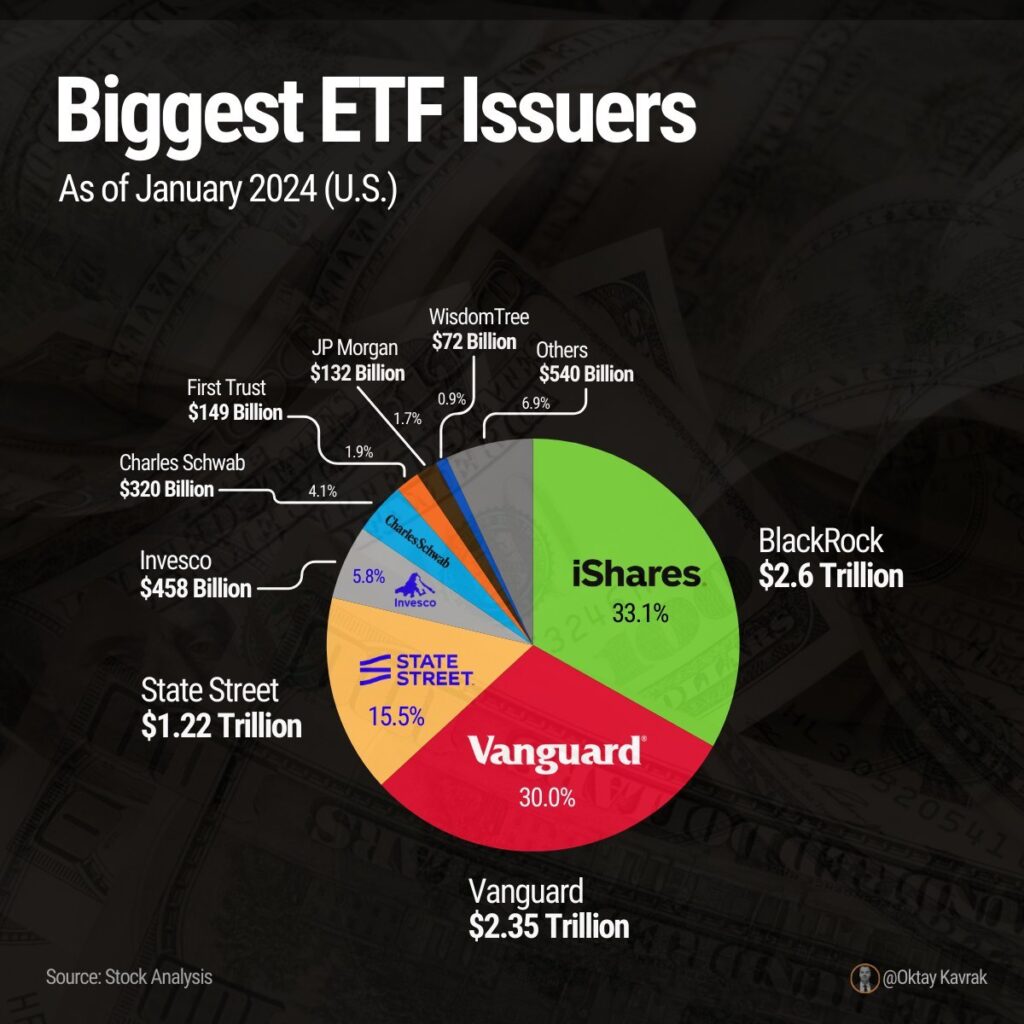

It’s on top of this Morgan Stanley index that today’s ETF was created: the MSCI World. This is a fund from iShares, one of the largest ETF issuers in the world, with over $2 trillion in 800 products. Founded in 2000, iShares is now a subsidiary of BlackRock, one of the largest investment managers in the world.”

The European Union Standard

The framework of this ETF is very secure; you can see here at the end of the name UCITS (iShares Core MSCI World UCITS), Undertakings for Collective Investment in Transferable Securities, which is a European Union standard for the management and offering of mutual funds, providing much more security and protection for the investor.

So now you understand this ETF: it is from the iShares manager, replicates the Core World index from Morgan Stanley, and is benchmarked by the UCITS of the European Union.

The Recommended Broker

The brokerage I use for international markets, outside of Brazil, is XTB, one of the largest in the world, with almost 20 years of experience and based in the European Union, therefore regulated by the best regulatory bodies in the field, providing security for its nearly 1 million investors and offering Portuguese customer support 24 hours a day, 7 days a week.

Today we have a partnership with XTB here on the channel, but I only recommend it to my audience because it is an excellent and reliable brokerage, and it is the one I use for my investments. The ticker for this ETF on XTB is EUNL.DE. DE stands for Deutschland, because it is traded on the Frankfurt Stock Exchange in Germany.”

Over 1400 Assets from All Sectors

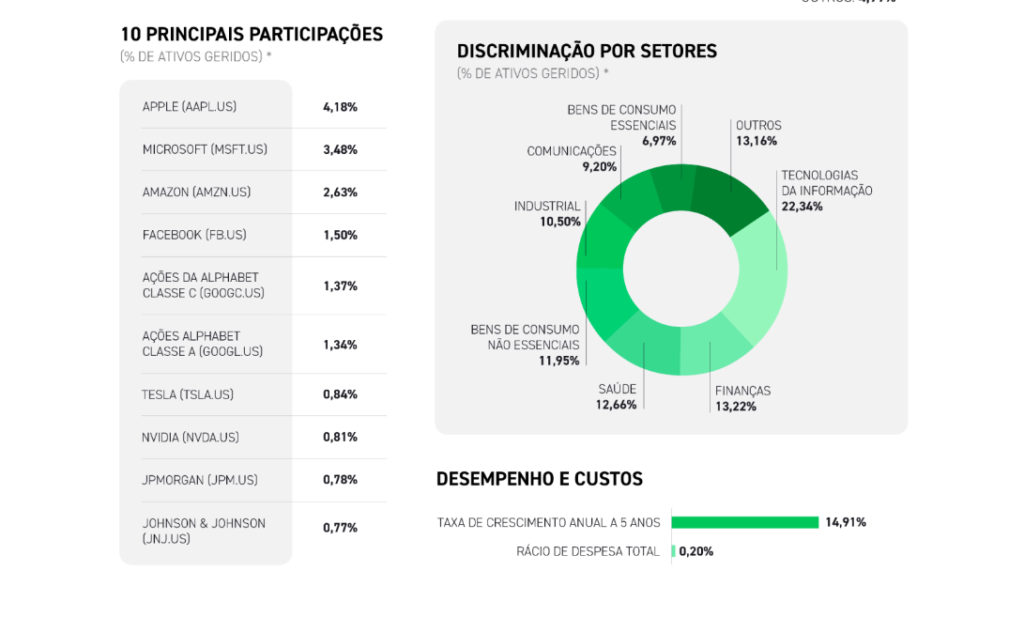

The components of this index come from all sectors of the economy, especially from Big Tech: 22% Technology, 13% Finance, 12% Health, in addition to Consumer Goods, Industrial, and Communications. It’s highly diversified in terms of sectors.

This ETF gathers almost more than 1,400 assets, so it’s unlikely that a small investor could replicate this portfolio on their own by individually buying the stocks. However, by purchasing the ETF, they are indirectly acquiring these securities.”

The Largest Companies in the Developed World

In one fell swoop, you’ll become a shareholder in all the Big Tech giants: Apple, Microsoft, Amazon, Facebook, Google, Tesla, Nvidia, along with JPMorgan, Johnson & Johnson, and hundreds of others. These are just the top 10 positions in this fund, which manages 72 billion dollars in assets and has seen an appreciation of almost 15% per year over the last 5 years, charging only a 0.2% management fee.

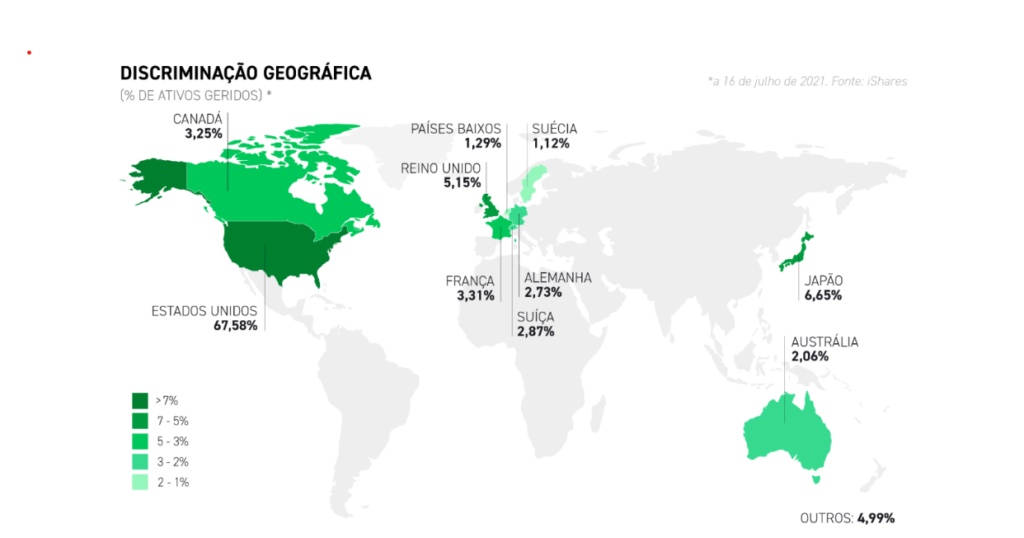

Regarding geographical distribution, 60% of this ETF consists of US stocks, such as the ones I mentioned among the top 10 positions. Japan comes in second, with over 6% of the stocks coming from there, and several other countries, totaling 23 developed countries.

This is an accumulating ETF, meaning that when these companies pay dividends, they are reinvested to purchase more of that stock for the ETF, at no extra cost to the shareholder. The other type would be a distributing ETF, which would distribute the dividends to the shareholders.

Watch my video about the Developed World ETF:

One Response