Copper is the third-largest metal market in the world, with an annual production of 22 million tons, generating nearly $200 billion, trailing only iron ore and gold.

It’s the second most electrically conductive metal after silver, but with a better cost-benefit ratio, costing 80 times less: a ton of copper is priced at $9,000, while silver costs $700,000 per ton.

Of course, these prices are always changing, but later on, we’ll delve into the technical analysis of copper. In this article, you’ll learn the most important information about this market and how to profit from this indispensable metal for the modern economy.

From the Bronze Age to the New Oil

As we transition from oil to electricity, copper will be increasingly in demand, and this market is expected to grow by over 4.5% annually until 2030, with copper already being dubbed “the new oil,” with prices potentially rising from the current $9,000 to over $20,000 per ton.

And it’s not the first time. Copper is the oldest metal used by humanity, with 10,000 years of history, but its greatest impact was 5,000 years ago when we learned to alloy it with other metals, leading us from the Stone Age to the Bronze Age since bronze is not a natural element like gold and silver.

Bronze is a human creation, a metal alloy of copper with other metals, usually tin. Before that, humanity could only work with wood and stone, so copper provided a significant advancement to civilization.

Copper in the Modern World

The modern world relies on copper: in electrical wires, telecommunication cables, chips, solar panels, wind turbines, and digital equipment, from cell phones to computers. Seventy percent of copper is used in electronics, another 15% by the construction industry for water and heating pipes, as copper is a malleable metal resistant to heat and corrosion. Another 15% is used by other industries, such as transportation, in railroad tracks, and the medical equipment industry.

The largest consumers of copper are the fastest-growing countries, such as China, which absorbs 54% of global production, and those that produce more electronics, such as Japan, which uses 12 kg of copper per inhabitant per year, the United States 10 kg, and Europe 9 kg.

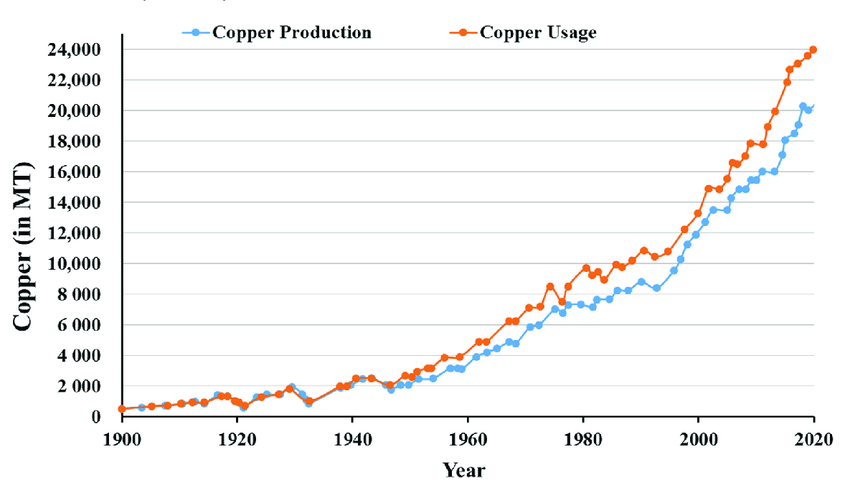

At the beginning of the 20th century, copper demand was half a million tons per year, and currently, it is 22 million. Copper is so intertwined with the modern economy that it is called “Doctor Copper”: a drop in price indicates a weak economy, and if the price of copper rises, it’s Doctor Copper’s diagnosis that the economy is doing well.

Who Produces Copper

The largest producer of copper, and where the two largest mines in the world are located, is Chile, with nearly 6 million tons per year, accounting for 27% of global production, more than the second and third-place combined, which are Peru, with 10%, and China, with 8%, followed by the Congo and the United States.

Copper production can be divided into 3 stages: mining, smelting, and refining. In mining, copper ore is extracted from underground or open-pit mines. In smelting, the raw ore is transformed into concentrate, and in refining, the purity level is increased.

How to Invest in Copper

The largest company in the industry is the Chilean Codelco, which produces 1.5 million tons of copper per year, and the second is Freeport, from Arizona, the American state with the most copper. In Brazil, 90% of the mines are located in Pará and Goiás, with the largest producers being Paranapanema and Vale.

The largest ETFs in the sector are CPER, which gathers various copper futures contracts, or COPX, which gathers shares of the 39 largest copper miners on the B3.

Check out my video on copper: