The world produces 180 million tons of sugar annually, a market worth $70 billion, growing by 1 to 2% per year, with 80% of this production coming from sugarcane and 20% from beets.

Sugar was one of the first commodities in history, and access to it remains a strategic issue for any country. Sugar not only serves as a sweetener but also plays a fundamental role in food technology, acting as a preservative, texturizer, flavoring agent, and fermentation agent.

Over 110 countries produce sugar

Therefore, over 110 countries around the world produce sugar, many spending billions of dollars annually on subsidies for cane and beet farmers. This widespread production and liquidity make sugar one of the most interesting commodities for traders.

In this article, we will explore everything about the sugar market: how it became one of the main commodities, what factors and risks influence its price, and I will present four possible strategies for profiting from sugar trading. Remember that in variable income investments, losses are also possible, so ensure you understand all the risks involved in trading financial instruments. And of course, this is not a recommendation to buy or sell sugar.

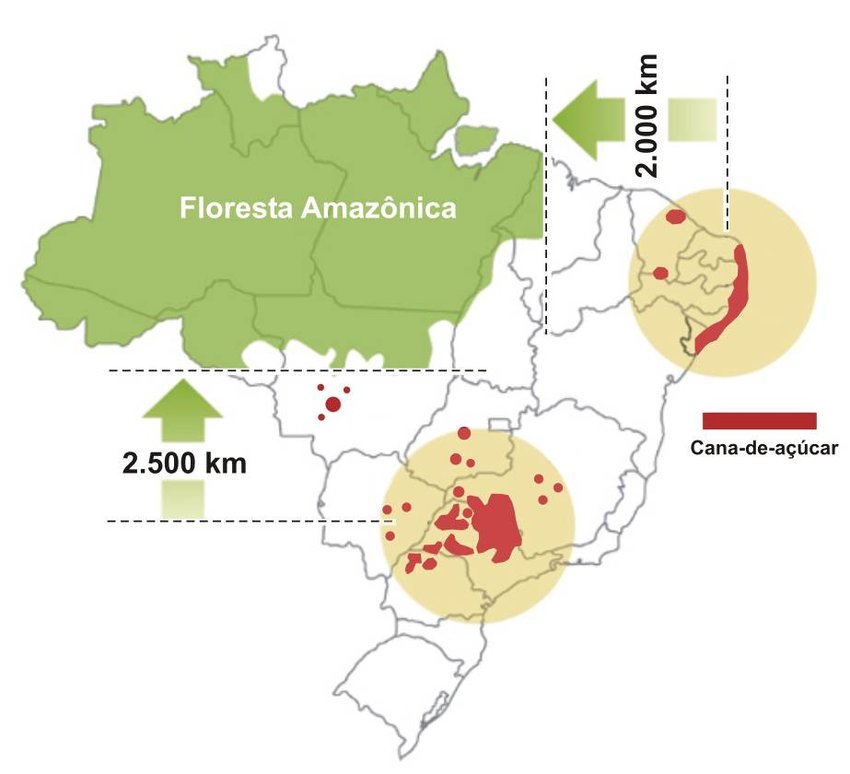

Brazil: The World’s Sugar Mill

Brazil remains the largest producer of sugarcane globally, with 600 million tons harvested annually, accounting for one-third of the world’s production. From this cane, the country produces 40 million tons of sugar, representing 22% of global production. More than half of Brazil’s sugarcane is allocated for ethanol production, making Brazil the second-largest ethanol producer, following the United States.

Sugarcane is used not only for sugar production but also for ethanol, as 80% of the Brazilian vehicle fleet is ‘flex-fuel’: capable of running on either gasoline or cane ethanol. This technology was developed during the Proálcool program, initiated after the oil shocks of the 1970s when Brazil imported 80% of its fuel. Today, Brazil is self-sufficient in fuel.

Depending on the prices of sugar and oil, Brazilian cane producers can easily switch between producing sugar for export or ethanol for domestic consumption, a model that India is attempting to replicate. Currently, the sugarcane production axis has shifted from the northeast to the southeast of the country, with São Paulo producing more than half of the national sugarcane and sugar output.

The sugar-energy complex, encompassing sugar and ethanol, exports over $10 billion annually, making it the fourth-largest economic sector in Brazil and responsible for generating 800,000 jobs across 350 plants throughout the country.

20% of Sugar Comes from Beets

However, not all sugar comes from cane; 20% of the world’s sugar comes from beets. Beet sugar was developed around 1750 by the Germans, who sought a way to avoid dependence on cane sugar, which only grows in tropical regions.

Beets, on the other hand, can be cultivated in other climates. Although all plants produce sucrose, which is the chemical name for the carbohydrate we call sugar, cane and beets are the plants with the highest sucrose content. To give you an idea, cane produces about 8 times more sugar than corn.

The Largest Sugar Producers in the World

After Brazil, the largest sugar producers in the world are India, Thailand, China, and the United States. India was once the largest sugar producer until 2020, but currently, it accounts for 17% of the production, totaling 30 million tons per year, compared to Brazil’s 22%, which tripled its cane production since the 1990s.

However, India remains the largest consumer of sugar in absolute terms, absorbing 1/6th of the world’s production, especially since in April 2023, India surpassed China as the most populous country in the world, with over 1.4 billion inhabitants.

Thailand and China each harvest around 10 million tons of cane per year, but due to China’s large population, they are also among the largest importers of sugar, along with Indonesia. The case of the United States is interesting because they import sugar but are also the 5th largest producer in the world, with 8 million tons per year. Of this production, 55% comes from beets and 45% from cane. Additionally, another 9 million tons are produced from another sweetener, corn fructose, which is liquid, and in this market, they are the leaders.

Sugar is Strategic

Worldwide, beet production accounts for 10% of cane production: 200 million tons per year, with the largest producers being France, Russia, and the United States. Meanwhile, the European Union, if considered as a single entity, would be the world’s third-largest sugar producer, with 16 million tons, most of which comes from beets, highly subsidized on the continent.

Sugar is such a crucial product for food technology that most countries either subsidize their producers and establish minimum prices or impose import tariffs. As a result, two-thirds of sugar is consumed domestically in each country, with only one-third reaching the international market. Nearly half of the international sugar comes from cane cultivated in the ‘sugar mill of the world,’ which is Brazil, where sugar becomes cheaper whenever the real depreciates against the dollar.

Four Factors Impacting Sugar Prices

Now that we’ve seen some numbers from this market, let’s understand the four main factors that impact sugar prices:

1. Weather Conditions:

Sugarcane is a plant that relies on ample arable land, warm climate, and abundant rainfall, making it susceptible to risks like wildfires, frosts, and droughts. The sugarcane harvest runs from May to November, when more sugarcane is available in the market, leading to lower sugar prices. However, in case of frosts or droughts, such as the one that hit Thailand in the 2020-21 season, less sugarcane is harvested, and sugar becomes more expensive. Conversely, excellent weather conditions lead to an abundance of sugar supply and lower prices.

2. Geopolitics:

Another factor to consider is government subsidy policies and geopolitical events. Without sugar, you cannot produce distilled spirits like rum and cachaça or fermented beverages like wine, beer, and bread, as sugar feeds the yeasts that produce alcohol and gas. Additionally, sugar serves as a flavoring and food preservative.

Therefore, countries implement various policies to protect their sugarcane and beet producers or create regulations to reduce sugar consumption. For instance, the war in Ukraine has driven up sugar prices as beet production has decreased by one-third, and less Russian fertilizer is reaching sugarcane producers, thereby increasing sugar costs.

3. Oil Prices:

A third factor influencing sugar prices is the price of oil itself. This is because sugarcane ethanol is a substitute for gasoline. When oil prices rise, more sugarcane will be allocated to biofuel production, reducing the availability of sugarcane for sugar production and driving up its price. Therefore, it’s essential to use intermarket analysis with oil and sugar.

4. Changes in Consumption Patterns:

The fourth and final factor impacting sugar prices is changes in consumption patterns. Currently, Americans have the highest per capita sugar consumption at 14 kg per person per year, followed by Mexico at 10 kg. However, the trend is that higher-income populations tend to consume less sugar.

The forecast is that per capita consumption of caloric sweeteners will only rise in Asia and Africa. Sugar represents 80% of the world’s sweeteners, corn syrup, another caloric sweetener, represents 10%, and the remainder consists of non-caloric sweeteners such as saccharin and aspartame. Therefore, tracking changes in sugar consumption patterns in each country is a fourth possible trading strategy.

Understanding Sugar Futures

Before we dive into the platform, let’s grasp one more concept: sugar futures contracts in the traditional financial market. The most commonly used benchmark is Sugar 11, which represents raw sugar. There’s also Sugar 5, referring to refined sugar found in households, and Sugar 16, representing American sugar. However, we’ll focus on the most traded one, Sugar 11, which originated in 1914 at ICE, the Intercontinental Exchange, now the world’s leading agricultural commodities exchange.

Each futures contract represents 112,000 pounds of raw sugar, approximately 50 metric tons, and the minimum price fluctuation, or tick value, is 1 cent per pound. I mention pounds to avoid confusion with the British pound sterling, which is a monetary unit, unlike the pound as a unit of mass, equivalent to 0.45 kilograms.

Nowadays, there are financial instruments available for trading commodities like sugar, making everything more accessible.

Watch the video where I show practical sugar trading: