The corn market is the largest market for agricultural commodities. In this article, we’ll cover everything about corn for those interested in the financial market, investments, and day trading.

There’s a commodities playlist on the channel, but enough talk, let’s dive into numbers, data, and metrics of this market. We’ll explore how to trade corn through derivatives, and we’ll even delve into the history of corn to make this article comprehensive.

Corn for Feed and Fuel

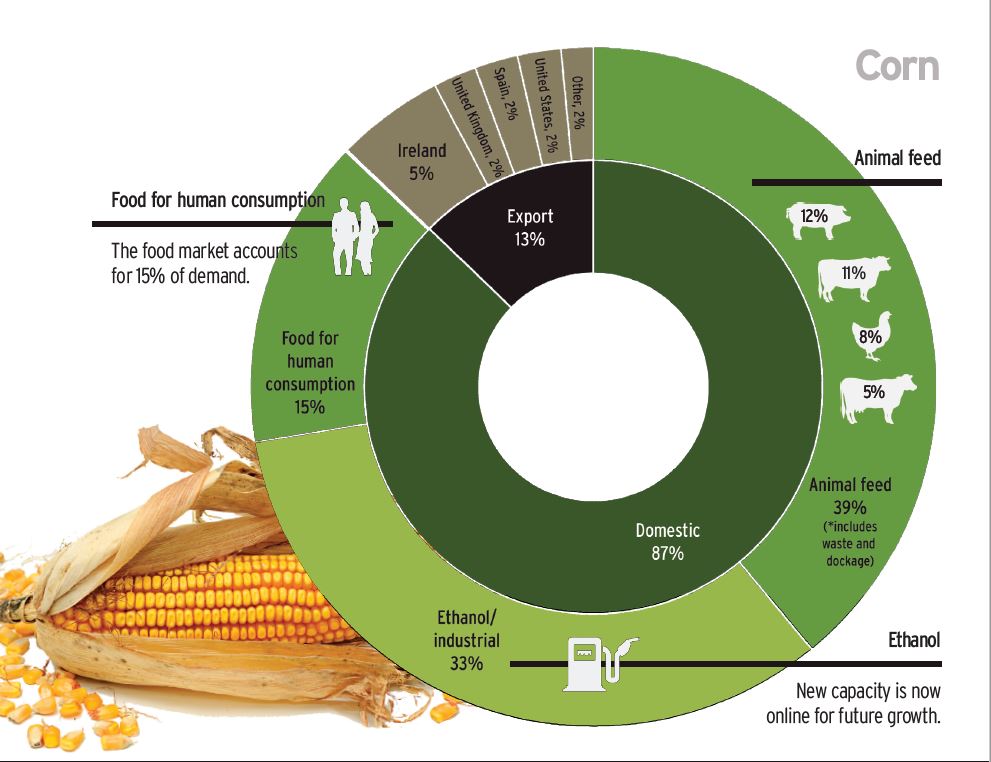

Corn, along with rice and wheat, accounts for two-thirds of the calories consumed by humanity. This market is massive. However, this isn’t solely due to people enjoying popcorn at the movies: only 10% of corn is used for human consumption. The other 90% is used for two purposes: feeding animals and producing biofuels.

This article is not a recommendation to buy corn; its purpose is to understand a bit more about this market. We’ll review some numbers, understand the production chain, where to access the most relevant data on corn production, and how to trade. We’re discussing the most important agricultural commodity in the world, so let’s explore everything about the corn market for investors and traders.

The Corn Production Chain

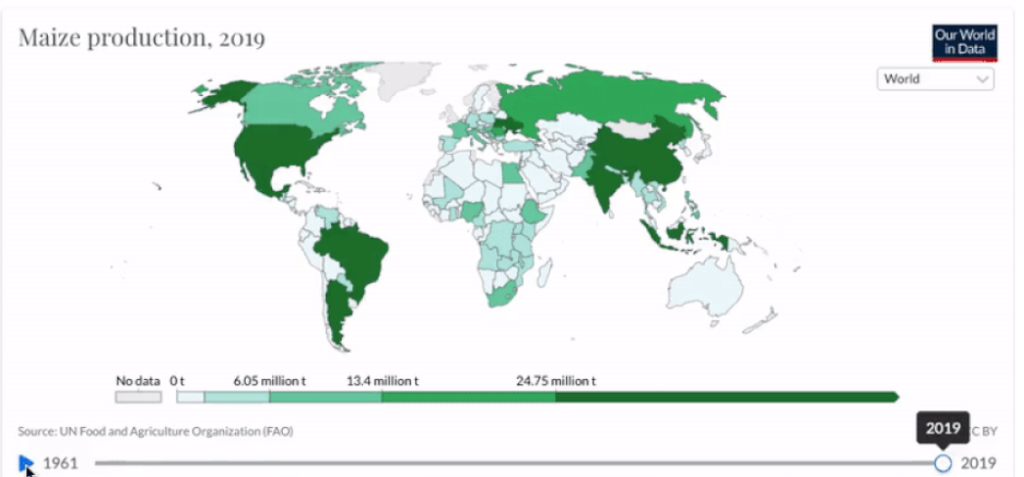

The world produces 1.2 billion tons of corn per year, more than any other grain. 35% of this production comes from the United States, which is the largest producer, consumer, and exporter of corn. Another 20% comes from China, and Brazil is the 3rd largest producer, with 120 million tons, equivalent to 10% of the world’s corn production, followed by Argentina, with about half of Brazil’s production.

The corn production chain starts with major seed producers. These seeds reach farmers, who cultivate the corn and deliver it to mills, where the grains are selected and dried. From there, they move on to distributors and manufacturers, who transform it into food, sweeteners, feed, and biofuel.

Fertile Soil in the American Midwest

I am writing this article at a time when corn futures prices have skyrocketed due to a drought in the United States, making it clear that investors and traders need to pay attention to such issues when trading corn or other agricultural commodities.

The summer period, when corn is growing in the soil, is the most volatile in the market. Any news about droughts or floods in the American Midwest can impact prices. For example, in 2023, a drought in the interior of the United States temporarily made Brazil the largest corn exporter. Most Brazilian corn comes from the southern states, the Midwest, and Minas Gerais.

Corn: From Field to Table

Agricultural markets are heavily influenced by seasonality, and the corn market, like the soybean market, tends to be more volatile during the growing season, from spring to autumn. This is the period of greatest uncertainty in agricultural production when the fields are sown and exposed to all sorts of risks, such as excessive rain or sun, and this uncertainty affects prices.

As the corn is harvested and it becomes clear how much corn will be available, uncertainty diminishes, and with it, the price volatility of corn tends to decrease post-harvest.

In addition to being used for animal feed, a significant portion of corn is currently used to produce biofuels. Even gasoline today contains 10% ethanol, an alcohol made from sugarcane or corn.

This versatility of corn has been made possible by several decades of research that have revealed all these uses for the plant. Today, corn represents a $90 billion market in the United States alone, and it is the largest crop by cultivated area in the country, with almost 400 square kilometers dedicated to corn cultivation. Corn plays a central role in the economy and rural culture of the United States.

Corn Futures Contracts

We trade corn through derivatives, whether they are futures contracts on stock exchanges or other types of instruments that are more accessible for those with limited capital. Trading a lot of corn on the exchange is much more expensive than trading a mini-index lot. Want an example?

The size of the corn futures contract in Brazil is 450 sacks of 60 kg, which equals 27 metric tons. Currently, it is being traded at around 60 reais per sack, so 60 times 450 equals 27,000 reais. Some brokers may require a margin of 3,000 reais to trade one contract, whereas with the mini-index, you can start with just 100 reais.

Therefore, trading corn futures can be expensive for the average person, leading many to seek other financial products in global markets. However, I cannot recommend at this time that residents of Brazil trade certain financial instruments.

Later, I will take a look at the corn chart, but I want to emphasize that this is not a brokerage recommendation nor a recommendation to buy corn.

Factors Impacting the Price of Corn

What influences the price of corn futures contracts? Various factors, such as weather conditions, the price of the dollar and oil, and demand from sectors like food and beverages. In the week I am writing this text, a Russian attack in Ukraine caused the price of corn to rise, so there are many factors impacting the price.

There are several ways to gain exposure to corn. You can buy shares of companies in the corn production chain, invest in agricultural commodity ETFs, trade futures contracts, or use contracts for difference. You need to see which method suits your profile and the regulations of your country.

Corn Futures Contracts

Corn futures contracts emerge as a way to protect corn producers from harvest risks: they sell a futures contract, taking a ‘short’ position in corn, aiming to avoid losses if corn prices drop by harvest time. On the other hand, industries that need to buy corn take a ‘long’ position: they buy these futures contracts to hedge against the possibility of corn prices rising.

This way, participants in the actual, physical corn market can plan their operations and reduce uncertainties while the fields are still being planted and exposed to various weather conditions.

Derivatives also allow speculative activity for those who want to trade only the price of corn without engaging in the physical product market. Traders seek to capitalize on price changes in this commodity, using trading strategies that you can also find on this channel.

Price Action enables you to profit from corn without having a direct connection to the physical corn market. The Price Action trader applies the same strategy to corn that they use for the dollar or bitcoin. Much of this article is geared towards long-term investors, but there are some insights here that will also benefit corn traders.

The History of Corn: An American Plant

As promised, let me tell you a bit about the history of corn for those of you who intend to enter this market. Corn was domesticated in Central America 10,000 years ago, originating from ‘teosinte’, a wild grass that bears little resemblance to modern corn. Over generations, people selected the best and most resistant varieties, and the cultivation of ‘maíz’ spread and soon reached natives throughout the Americas, from north to south.

When Columbus arrived in the late 15th century, corn supported tens of millions of people across the American continent, including in the Inca and Aztec empires.

Columbus himself encountered corn on the Caribbean islands and was fascinated by the plant, bringing it to Europe along with potatoes, tomatoes, pineapples, cocoa, and turkeys. Europe took a while to see corn as more than just pig feed, but nowadays, corn has conquered the old continent, and France and Ukraine are among the world’s largest corn producers.

It’s curious that Mexico, where corn originated, is now one of its largest importers because Mexico is a mountainous country, and there are so many tortillas being made that it’s worthwhile to bring some of that corn from the United States, which produces one-third of the world’s corn, largely thanks to the Mississippi River.

It’s no wonder that this is one of the most traditional commodities on the Chicago Board of Trade: it started in 1877 and remains the most liquid grain market in the world, with over 400,000 futures contracts traded daily.

Check out my video on the corn market: