Commodities are primary products of natural origin with low industrialization, and they are fungible: they are consumed after use and can be replaced by any of the same type, with no difference between brands.

Commodities are present in everything we use in the modern world, from energy and transportation to our food and that of animals. They play a fundamental role in various industries of the global economy, with prices being influenced by supply and demand, weather conditions, and economic growth.

I’ve created a playlist on the channel with 10 videos about the best commodities to invest in and trade. It features incredible images and the most relevant information about them, so be sure to check it out.

In this article, I’ve listed these 10 commodities by market value so that we can understand the patterns that emerge from them.

1st Energy

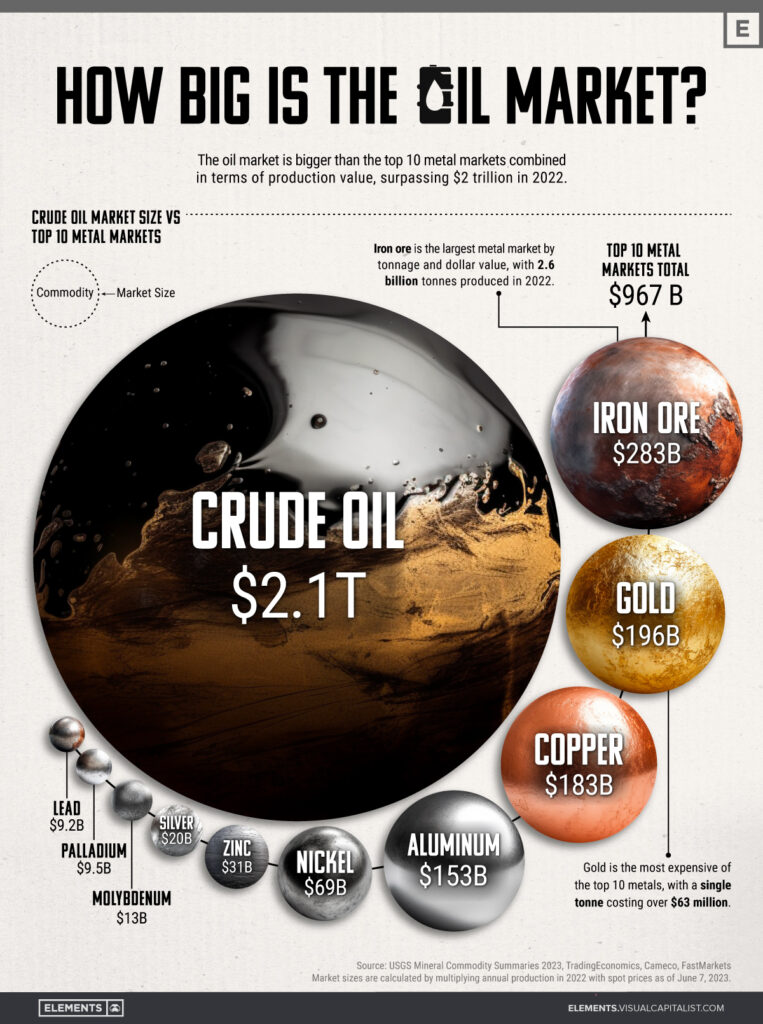

Oil and natural gas far surpass all other commodities in the world’s largest markets, with values of 2 trillion and 1 trillion, respectively, in a global economy estimated at 88 trillion dollars per year. This is because they form the foundation of the economy, being the energy used in all other industries and processes, with 4.5 billion tons of oil used annually and 2 trillion tons of natural gas.

2nd Agricultural

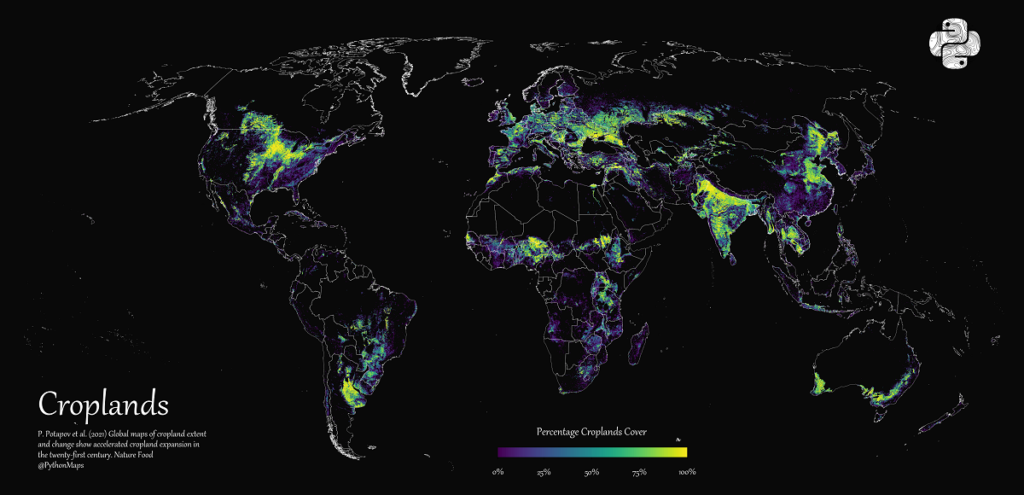

Next, as the 3rd and 4th largest commodity markets on our list, we have the agricultural duo: live cattle and its favorite companion, corn, the most cultivated plant on the planet, with only 10% used for human consumption, while the majority is used for producing ethanol fuel or animal feed. Serving a similar function to corn, as a biofuel and feed, comes soybeans, ranked eighth on our list.The fact that the live cattle market ranks third in size is symbolic, highlighting that food is a primary necessity in life. The complex cattle production chain, which spans years and involves thousands of participants and technologies, makes this market even more significant than agricultural and metal commodities.

3rd Metal

Metals are the next prominent category, with copper as the fifth largest market, at $200 billion, still ten times smaller than oil, and ten times larger than silver. It’s fascinating that silver, which we associate with wealth, is rarer than copper, primarily used in electronics, making it the metal of the modern world.

4º Luxury Goods

The last three commodities that complete our list also clearly form their own category, which includes coffee, sugar, and cocoa. These three are agricultural products but undergo a slight degree of industrialization to reach the final product we consume. While still markets worth tens of billions of dollars, they do not reach the hundreds of billions as they are luxury goods.

Despite their societal penetration, coffee, sugar, and cocoa are essential but not vital necessities like oil and gas energy and food such as cattle and corn.

The market size and trading

Remember that the market size we consider here is the sum of the value of companies directly involved in these sectors. However, if we consider all derivatives and leverage generated by each of these commodities, the size of the financial market becomes 20 to 30 times larger than the physical market for these products.

So, you have 20 times more liquidity than you would if futures contracts for cattle, for example, could only be traded by those buying or selling physical cattle. All this liquidity generated by investors is good for producers, farmers, and it’s great for us traders and investors, as we can profit from all these commodities based on a single rule and methodology, which is technical analysis.

I have articles on all the topics you need to profit from these commodities, and a YouTube playlist with beautiful imagery about them.

Check out my video on the 10 Commodities below: